Indian Railway Finance Corporation (IRFC) is a government-owned financing company established on 12 December 1986. The company is headquartered in New Delhi, India. It provides financial assistance to the Indian Railways. IRFC was incorporated under the Companies Act, 1986. Was incorporated under 1956.

The first objective of IRFC is to raise funds from domestic and international markets to finance the expansion and modernization of Indian Railways.

The company is also known as the sole borrowing agency of the Indian Railways, and works under the administrative control of the Ministry of Railways, Government of India. The company is majority owned by the Government of India while the Ministry of Railways has administrative control over it. Is.

IRFC has a diverse portfolio of financial products, including leasing, lending and financing. The company provides financing for the acquisition of rolling stock, including locomotives, coaches, wagons and other railway-related equipment. It also finances infrastructure projects such as construction of new railway lines, bridges and stations.

The company has long term credit ratings from both domestic rating agencies as well as international rating agencies such as Fitch Ratings, Moody’s Investor Service and Standard & Poor’s.

IRFC has a good and strong presence in the Indian debt market, and has been successful in raising funds using bonds and debentures. The company has issued bonds in various currencies including Indian Rupee, US Dollar and Japanese Yen.

IRFC has a large customer base including Indian Railways, State Governments and other public sector undertakings. The Company has a well-established risk management framework, which helps it effectively manage its credit, market and operational risks.

IRFC also works for social responsibility initiatives along with its core work. The company has played a significant role in doing many things in the fields of education, health and environment, and it also contributed to the Swachh Bharat Abhiyan and the Prime Minister’s Relief Fund. Is.

Thus, IRFC plays a vital role in the development of expansion of Indian Railways by providing financial assistance to keep pace with the expansion timeline. The company also has a strong financial position, a diversified product portfolio and a well-established risk management framework.

Company’s Business Model Of IRFC

Indian Railway Finance Corporation (IRFC) is a financing company that primarily provides financial support to Indian Railways, the largest rail network in Asia.

And it is also the world’s second largest network under single management. IRFC’s business model focuses on raising funds from domestic and international markets to finance the expansion and modernization of Indian Railways.

The company works under the administrative control of the Ministry of Railways, Government of India and is known as the sole borrowing agency of the Indian Railways. Talking about the business model of IRFC, it works for three main things: leasing, lending and financing.

Leasing: IRFC provides lease financing for the acquisition of rolling stock, including locomotives, coaches, wagons and similar railway equipment. The company acquires these assets and leases them to the Indian Railways for a specific period of time. This is how the company does leasing work

Lending: IRFC also provides credit facilities to Indian Railways for infrastructure projects such as construction of new railway lines, bridges and stations. IRFC’s lending activities are aimed at assisting the government in expanding the railway network and improving its efficiency. Designed with purpose.

Financing: IRFC raises funds through Bonds, Debentures and other similar debt instruments to finance its leasing and lending activities.

The company has a strong presence in the Indian debt market, and has so far been successful in raising funds through different currencies including Indian Rupee, US Dollar and Japanese Yen. IRFC’s funding strategy is aimed at maintaining a diverse funding base and minimizing the cost of funds.

Overall, IRFC’s business model continues to focus on a low-risk, asset-backed approach supported by special support from Indian Railways. The company has a good long-term credit rating, which reflects its financial strength and stability.

IRFC’s business model is aligned with the Government of India’s focus on the development of basic infrastructure and expansion of the railway network. The government has made announcements for the modernization of the railway network and continuous new developments.

Which can provide important development opportunities for IRFC. In this way, the business model of the company is continuously moving forward while working for its development and expansion.

Read Also – FCS Software Share Price Target 2025,2024,2023,2028, 2030

Performance Of IRFC Company

Indian Railway Finance Corporation has been instrumental in the development of the Indian Railway sector and has contributed significantly to the growth of the Indian economy. The performance of IRFC can be analyzed in terms of its financial performance, business growth and market position as follows-

Financial performance: IRFC has consistently delivered good financial performance over the years, utilizing its sound business model and reflecting a strong risk management framework.

According to the data of December 2022, the company’s revenue has been recorded at about 3.82%, the net income of IRFC has been more than about 2.48%, this shows the good condition of the company.

Looking at IRFC’s funding strategy, it pays special attention to maintaining a diverse funding base and reducing the cost of funds. The company raises funds through bonds, debentures and other debt instruments in various currencies.

Business growth : IRFC’s business development is moving forward with a focus on modernization and expansion of the Indian Railways sector. The company’s leasing business, along with rolling stock and other acquisitions of railway equipment, has served as a major source of growth.

In FY2021, the company acquired around 187 locomotives, 7,356 wagons and 814 coaches with a total investment of around Rs 14,380 crore. Similarly, the landing work of the company also gives huge profits to the company.

Read Also – BEL SHARE PRICE TARGET 2022,2023,2024,2025,2026,2027,2028,2029,2030,2040

IRFC’s business growth has been supported by its strong credit rating and that of Indian Railways. The company’s low-risk, asset-backed business model has enabled it to raise funds at reasonable costs and offer affordable leasing and lending rates. Along with all this, environmental and social responsibility also took the company forward.

Market conditions: IRFC is growing as a major player in the Indian loan market with a strong presence in both domestic and international markets.

The company has been successful in raising funds through various instruments, including green bonds, social bonds and masala bonds. IRFC’s strong credit rating and low-risk business model have enabled it to offer its customers competitive edge and attract investors.

The company has signed MoUs with various organizations including Power Finance Corporation, NTPC Limited and Export-Import Bank of India (Exim Bank) to explore collaboration and cooperation opportunities. IRFC’s partnerships have enabled it to leverage its strengths and grow and expand itself.

Overall, IRFC has shown good financial performance with the help of its strong business model and robust risk management framework.

The company’s focus on modernization and expansion of the Indian Railways sector has contributed significantly to the growth of the Indian economy.

IRFC’s low-risk, asset-backed business model has enabled it to scale and through these, the company is moving towards continuous expansion, which can enable the company to expand further and earn profits in the future.

Read Also – Asian Paints Share Price Target 2023,2025,2028,2030,2040

Basics Of IRFC

The Indian Railway Finance Corporation (IRFC) is a government-owned financial institution established by the Government of India with the objective of providing financial support to the Indian Railways.

Company Name-Indian Railway Finance Corp Ltd.

Year of Establishment- 1986

Headquarters- New Delhi, India

IRFC is a non-banking financial company (NBFC) registered with RBI. It functions under the administrative control of the Ministry of Railways, Government of India, and is designated as the sole borrowing agency of the Indian Railways.

The first objective of IRFC is to provide financial assistance to Indian Railways for their capital expenditure programmes, including rolling stock, infrastructure projects and working capital needs.

IRFC raises funds through bonds, debentures and other debt instruments to finance its leasing and lending activities.

IRFC’s operations are divided into three categories: Leasing, Lending and Financing.

IRFC has a strong credit rating, reflecting its financial strength.

IRFC has played an important role in the development of the Indian Railways sector. The company has provided financial facilities to many major projects like dedicated freight corridor and has provided special assistance in the expansion and modernization of the railway network. The role of IRFC is important in the Indian Railways sector.

Because the railway sector has a major contribution in the economic development of India. The railway sector is also the largest employer in India and plays an important role in the movement of goods and people across the country as it enables people to cover greater distances in less time.

IRFC also has a strong corporate governance framework that oversees transparency, and ethical business practices within itself. The company has a Board of Directors which also includes the Independent Director and senior officers of the Ministry of Railways.

Read Also – Metro Brands Share Price Target 2023,2024,2025,2028,2030,2040|Earn

Overall it can be said that, IRFC is a government owned financial institution which provides financial assistance to Indian Railways for their capital expenditure. The business model of the company includes leasing, lending and financing, thus helping in the improvement of this sector as well as the Indian economy.

Fundamental Analysis Of IRFC

Update soon

Share Holders & Holding Pattern Of IRFC

| Shareholding Pattern – Indian Railway Finance Corporation Ltd. | ||

| Holder’s Name | No of Shares | % Share Holding |

| NoOfShares | 13068506000 | 100% |

| Promoters | 11286437000 | 86.36% |

| ForeignInstitutions | 149360058 | 1.14% |

| NBanksMutualFunds | 179089208 | 1.37% |

| Others | 120757012 | 0.92% |

| GeneralPublic | 1168933857 | 8.94% |

| FinancialInstitutions | 163928865 | 1.25% |

Services Given By IRFC

Update Soon

Share Price History Of IRFC

Update Soon

Similar Stocks Of IRFC

| Name | Last Price | Market Cap. (Rs. cr.) | Sales Turnover | Net Profit | Total Assets |

| Bajaj Finance | 6,200.05 | 375,369.15 | 35,681.20 | 10,289.74 | 165,096.13 |

| Bajaj Holdings | 6,650.25 | 74,012.97 | 1,776.46 | 1,630.52 | 15,387.86 |

| Chola Invest. | 854.40 | 70,235.13 | 10,048.29 | 2,146.71 | 80,881.18 |

| Shriram Finance | 1,405.55 | 52,627.63 | 19,255.17 | 2,707.93 | 94,558.10 |

| IRFC | 31.45 | 41,100.45 | 20,298.27 | 6,089.84 | 429,412.96 |

| Muthoot Finance | 1,012.10 | 40,630.58 | 11,082.32 | 3,954.30 | 68,155.81 |

| M&M Financial | 256.85 | 31,734.59 | 9,657.97 | 988.75 | 71,442.01 |

| Sundaram Fin | 2,334.35 | 25,935.53 | 3,870.03 | 903.41 | 34,728.37 |

| Poonawalla Fin | 319.25 | 24,516.73 | 1,940.33 | 584.94 | 12,440.33 |

| L&T Finance | 90.85 | 22,527.81 | 335.87 | 218.18 | 11,375.95 |

| Piramal Enter | 714.60 | 17,054.91 | 2,225.68 | 572.28 | 28,968.66 |

| CreditAccess Gr | 972.95 | 15,460.80 | 2,289.39 | 382.14 | 14,424.86 |

| Shriram City | 1,921.80 | 12,881.09 | 6,526.76 | 1,086.19 | 39,604.29 |

| Bharat Fin | 898.00 | 12,594.17 | 3,036.64 | 984.60 | 9,002.97 |

| Tata Inv Corp | 2,149.05 | 10,873.18 | 253.38 | 201.36 | 19,532.85 |

| Manappuram Fin | 127.90 | 10,825.39 | 4,562.80 | 1,304.54 | 25,868.85 |

| Motilal Oswal | 626.85 | 9,274.07 | 2,571.84 | 706.82 | 6,414.02 |

| Capital First | 587.20 | 5,817.54 | 3,592.96 | 327.01 | 19,788.51 |

| Edelweiss | 56.85 | 5,362.52 | 836.44 | 933.36 | 7,432.43 |

| M&M FS – RE | 79.85 | 4,932.85 | — | — | – |

| Spandana Sphoor | 589.80 | 4,186.71 | 1,376.34 | 46.64 | 6,662.99 |

| Paisalo Digital | 50.95 | 2,287.77 | 356.40 | 78.71 | 2,493.97 |

| Indostar Capita | 128.15 | 1,743.86 | 1,042.19 | -769.19 | 8,360.99 |

| Ugro Capital | 170.95 | 1,319.23 | 307.27 | 14.55 | 2,768.41 |

| Arman Financial | 1,442.45 | 1,224.98 | 62.41 | 16.23 | 318.93 |

| PNB Gilts | 58.75 | 1,057.56 | 989.72 | 165.71 | 15,957.61 |

| PTC India End | 14.35 | 921.68 | 952.88 | 129.98 | 9,381.39 |

| Vardhaman Hold | 2,668.75 | 851.74 | 114.98 | 83.36 | 794.38 |

| Cheap Sundar | 235.35 | 748.66 | — | -0.39 | 272.82 |

| Summit Sec | 605.75 | 660.38 | 29.63 | 19.83 | 2,335.50 |

| Muthoot Cap | 292.10 | 480.43 | 397.49 | -171.93 | 2,012.42 |

| Nahar Capital | 285.55 | 478.19 | 36.75 | 30.43 | 805.39 |

| CSL Fin | 222.40 | 461.09 | 74.63 | 33.45 | 525.65 |

| Baid Finserv | 35.75 | 429.24 | 49.94 | 8.79 | 305.60 |

| The Investment | 76.90 | 401.74 | 115.01 | 0.95 | 477.52 |

| NBI Industrial | 1,470.00 | 361.15 | 12.26 | 7.94 | 2,138.52 |

| Consol Finvest | 104.85 | 338.94 | 11.95 | 0.61 | 502.14 |

| SIL Invest | 298.00 | 315.76 | 42.82 | 29.12 | 1,917.44 |

| Rel Capital | 9.15 | 231.23 | 16.00 | -1,106.00 | 8,730.18 |

| Industrial Inv | 80.55 | 181.62 | 9.40 | -99.60 | 312.43 |

| Coral India End | 32.75 | 131.99 | 27.50 | 17.37 | 142.01 |

| Sakthi Finance | 18.90 | 122.29 | 181.34 | 9.52 | 1,249.91 |

| SREI Infra | 2.40 | 120.74 | 27.71 | 15.73 | 313.11 |

| Motor and Gen F | 29.75 | 115.21 | 4.18 | -1.78 | 81.48 |

| Starteck Financ | 111.95 | 110.95 | 15.89 | 9.36 | 253.46 |

| Capital Trust | 66.60 | 108.97 | 105.62 | -12.32 | 375.76 |

| McDowell Hold | 68.75 | 96.20 | 0.35 | -2.85 | 957.75 |

| Hb Stockholm | 46.65 | 33.30 | 17.71 | 15.24 | 69.90 |

| Lakshmi Finance | 107.45 | 32.24 | 7.51 | 5.71 | 47.03 |

| Transwarranty | 9.15 | 29.10 | 6.72 | -2.36 | 54.39 |

| Nagreeka Chap | 22.30 | 28.13 | 15.56 | 3.59 | 161.10 |

| Williamson Magician | 17.85 | 19.56 | 25.97 | -14.50 | 445.13 |

| Viji Finance | 2.10 | 17.33 | 1.22 | 0.44 | 16.38 |

| DCM Financial | 5.65 | 12.50 | — | 0.48 | 35.06 |

| Guj Lease Fin | 2.35 | 6.37 | — | -0.08 | 5.57 |

| TCI Finance | 2.75 | 3.54 | 4.53 | -32.96 | -23.93 |

| C&KFS | 0.35 | 2.55 | 101.86 | 3.34 | 489.55 |

| Construction Int | 89.05 | 0.00 | — | — | – |

| SBI ETF PVT BAN | 218.01 | 0.00 | — | — | – |

Read Also – HAL Share Price Target 2023,2025,2028,2030,2040|Earn

History Of IRFC

Update Soon

Net Worth Of IRFC

Market capitalization of IRFC is ₹411.40 Billion.

Income Statement Analysis Of IRFC

- Interest income during the year grew 28.7% on a year-on-year (YoY) basis.

- Interest expense had increased by 25.3% during the same period.

- Operating expenses increased by 8.3% during the year.

- The company’s net interest income (NII) grew by 37.3% during the financial year. As a result, net interest margin (NIM) witnessed an increase and stood at 54.1% in FY22 as against 25.6% in FY21.

- Other income increased by 498.2% during the year.

- Net profit for the year increased by 37.9%.

- Net profit margin increased during the year from 28.0% in FY21 to 30.0% in FY22.

| No. of Mths Year Ending | 12 Mar-21* | 12 Mar-22* | % Change | |

|---|---|---|---|---|

| Interest Income | Rs m | 157,705 | 202,993 | 28.7% |

| Other Income | Rs m | 4 | 23 | 498.2% |

| Interest Expense | Rs m | 112,371 | 140,748 | 25.3% |

| Net Interest Income | Rs m | 45,334 | 62,245 | 37.3% |

| Operating Expense | Rs m | 1,132 | 1,226 | 8.3% |

| Pre-provision Operating Profit | Rs m | 44,206 | 61,042 | 38.1% |

| Provisions & Contingencies | Rs m | 6,764 | 643 | -90.5% |

| Profit before tax | Rs m | 44,161 | 60,902 | 37.9% |

| Tax | Rs m | 0 | 3 | 0.0% |

| Profit after tax | Rs m | 44,161 | 60,898 | 37.9% |

| Minority Interest | Rs m | 0 | 0 | 0.0% |

| Net Interest Margin | % | 25.6 | 54.1 | |

| Net profit margin | % | 28.0 | 30.0 | |

Source: Accord Fintech, Equitymaster

Valuation Of IRFC(You Can Click On Chart For live)

Vision & Value Of IRFC

Update soon

Products Of IRFC

Update Soon

Competitor Comparision Of IRFC

| Company Name | LTP (₹) | P/E (%) | Quantity Cap (₹Cr.) | NP Qtr (₹Cr.) | Div.Yield (%) | Sales Qtr (₹.Cr) | Book Value (₹) |

|---|---|---|---|---|---|---|---|

| Housing Development Finance Corporation Ltd HDFC | 2,773.50 BSE | 32.80 | 5,08,814.44 | 3,690.80 | 1.07 | 15,230.12 | 672.88 |

| Bajaj Finance Ltd BAJFINANCE | 6,199.45 BSE | 36.47 | 3,75,320.72 | 2,837.36 | 0.48 | 9,455.22 | 850.53 |

| Bajaj Finserv Ltd BAJAJFINSV | 1,359.95 BSE | 295.64 | 2,16,614.94 | 4.93 | 0.06 | 32.84 | 32.95 |

| SBI Cards & Payment Services Ltd SBICARD | 784.10 BSE | 33.07 | 74,181.69 | 509.46 | 0.32 | 3,507.12 | 94.30 |

| Bajaj Holdings & Investment Ltd BAJAJHLDNG | 6,679.90 BSE | 43.21 | 73,999.50 | 49.24 | 1.73 | 90.54 | 1,415.57 |

SOURCE- Indiainfoline

Speciality Of IRFC In Its Sector

Update soon

Revenue Distribution By Sectors Of IRFC

Update soon

Balance Sheet Analysis Of IRFC

| BALANCE SHEET OF INDIAN RAILWAY FINANCE CORPORATION (in Rs. Cr.) | MAR 22 | MAR 21 | MAR 20 | MAR 19 | MAR 18 | |

| 12 mths | 12 mths | 12 mths | 12 mths | 12 mths | ||

| EQUITIES AND LIABILITIES | ||||||

| SHAREHOLDER’S FUNDS | ||||||

| Equity Share Capital | 13,068.51 | 13,068.51 | 11,880.46 | 9,380.46 | 6,526.46 | |

| TOTAL SHARE CAPITAL | 13,068.51 | 13,068.51 | 11,880.46 | 9,380.46 | 6,526.46 | |

| Reserves and Surplus | 27,927.83 | 22,844.88 | 19,081.97 | 15,648.19 | 7,038.75 | |

| TOTAL RESERVES AND SURPLUS | 27,927.83 | 22,844.88 | 19,081.97 | 15,648.19 | 7,038.75 | |

| TOTAL SHAREHOLDERS FUNDS | 40,996.34 | 35,913.38 | 30,962.43 | 25,028.65 | 13,565.21 | |

| NON-CURRENT LIABILITIES | ||||||

| Long Term Borrowings | 0.00 | 178,574.79 | 155,290.46 | 173,932.68 | 114,854.13 | |

| Deferred Tax Liabilities [Net] | 0.00 | 0.00 | 0.00 | 0.00 | 6,389.92 | |

| Other Long Term Liabilities | 473.64 | 1,379.96 | 32.22 | 7.78 | 2,050.29 | |

| Long Term Provisions | 53.57 | 29.12 | 13.80 | 11.80 | 1.51 | |

| TOTAL NON-CURRENT LIABILITIES | 527.21 | 179,983.87 | 155,336.48 | 173,952.26 | 123,295.85 | |

| CURRENT LIABILITIES | ||||||

| Short Term Borrowings | 388,416.62 | 144,535.89 | 79,086.27 | 0.00 | 4,966.79 | |

| Trade Payables | 24.57 | 50.76 | 37.76 | 12.18 | 0.00 | |

| Other Current Liabilities | 20,015.48 | 17,567.81 | 10,511.23 | 7,610.52 | 20,283.98 | |

| Short Term Provisions | 0.00 | 0.00 | 0.00 | 0.00 | 220.31 | |

| TOTAL CURRENT LIABILITIES | 408,456.67 | 162,154.47 | 89,635.26 | 7,622.70 | 25,471.07 | |

| TOTAL CAPITAL AND LIABILITIES | 449,980.22 | 378,051.72 | 275,934.17 | 206,603.61 | 162,332.13 | |

| ASSETS | ||||||

| NON-CURRENT ASSETS | ||||||

| Tangible Assets | 36.31 | 45.32 | 11.00 | 11.23 | 11.27 | |

| Intangible Assets | 1.65 | 0.04 | 0.04 | 0.05 | 0.03 | |

| Capital Work-In-Progress | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Other Assets | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| FIXED ASSETS | 37.96 | 45.36 | 11.05 | 11.28 | 11.29 | |

| Non-Current Investments | 0.00 | 0.00 | 0.00 | 0.00 | 5.33 | |

| Deferred Tax Assets [Net] | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Long Term Loans And Advances | 0.00 | 0.00 | 0.00 | 0.00 | 144,230.95 | |

| Other Non-Current Assets | 17,131.34 | 7,792.39 | 2,058.95 | 1,545.40 | 3,978.37 | |

| TOTAL NON-CURRENT ASSETS | 17,169.30 | 7,837.74 | 2,069.99 | 1,556.67 | 148,225.94 | |

| CURRENT ASSETS | ||||||

| Current Investments | 10.00 | 11.98 | 11.51 | 13.15 | 1.21 | |

| Inventories | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Trade Receivables | 200,692.50 | 165,568.99 | 148,579.80 | 125,026.51 | 0.00 | |

| Cash And Cash Equivalents | 303.38 | 458.92 | 100.76 | 81.07 | 99.82 | |

| Short Term Loans And Advances | 6,824.81 | 6,969.82 | 6,423.37 | 5,895.49 | 3,328.10 | |

| OtherCurrentAssets | 224,980.24 | 197,204.26 | 118,748.73 | 74,030.73 | 10,677.06 | |

| TOTAL CURRENT ASSETS | 432,810.93 | 370,213.98 | 273,864.18 | 205,046.94 | 14,106.19 | |

| TOTAL ASSETS | 449,980.22 | 378,051.72 | 275,934.17 | 206,603.61 | 162,332.13 | |

| OTHER ADDITIONAL INFORMATION | ||||||

| CONTINGENT LIABILITIES, COMMITMENTS | ||||||

| Contingent Liabilities | 0.42 | 0.42 | 0.43 | 0.43 | 1.00 | |

| CIF VALUE OF IMPORTS | ||||||

| Raw Materials | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Stores, Spares And Loose Tools | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Trade/Other Goods | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Capital Goods | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| EXPENDITURE IN FOREIGN EXCHANGE | ||||||

| Expenditure In Foreign Currency | 0.00 | 1,050.09 | 496.30 | 466.56 | 376.53 | |

| REMITTANCES IN FOREIGN CURRENCIES FOR DIVIDENDS | ||||||

| Dividend Remittance In Foreign Currency | — | — | — | — | — | |

| EARNINGS IN FOREIGN EXCHANGE | ||||||

| FOB Value Of Goods | — | — | — | — | — | |

| Other Earnings | — | — | — | — | — | |

| BONUS DETAILS | ||||||

| Bonus Equity Share Capital | — | — | — | — | — | |

| NON-CURRENT INVESTMENTS | ||||||

| Non-Current Investments Quoted Market Value | — | — | — | — | — | |

| Non-Current Investments Unquoted Book Value | — | — | — | — | 5.33 | |

| CURRENT INVESTMENTS | ||||||

| Current Investments Quoted Market Value | — | — | — | — | — | |

| Current Investments Unquoted Book Value | — | — | 11.51 | — | 1.21 |

Source : Dion Global Solutions Limited,MONEYCONTROL

Annual Reports Of IRFC

IRFC Share Price Today Live Chart

IRFC Business Analysis

Financial Strength IRFC

Update soon

IRFC Share Price Target 2023, 2024, 2025, 2026, 2027, 2028, 2029, 2030,2040

We here at financesharetargets. in is going to give you estimated information about stock predictions, price predictions and targets for 2023, 2024, 2025, 2026, 2027, 2028, 2029, 2030 and 2040.

Please keep one thing in mind that this forecast, prediction or any target is only a suggestion given by our analysis.

It is almost impossible for any forecast/prediction to be correct. Errors are always present in any analysis, but we try our best to give you good price stock forecasts/predictions.

IRFC Share price target 2023

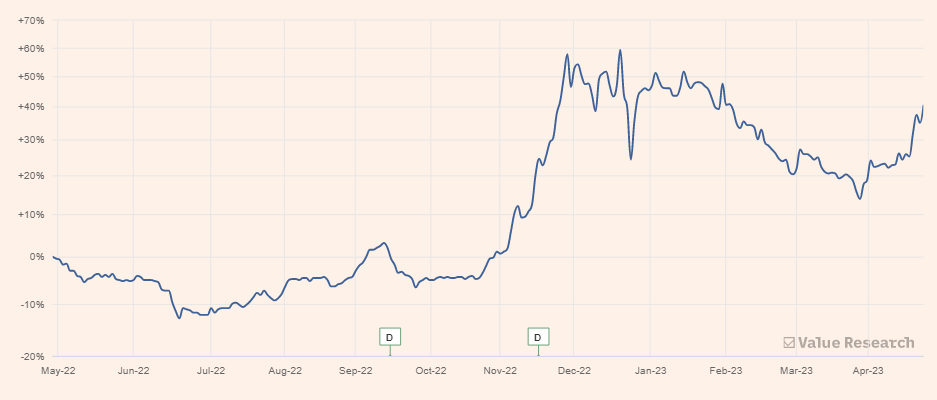

If we look at the share price of IRFC on NSE, the company has given a return of about 23.33% since the last week of April, whereas if we look at the maximum returns of the company’s share price, the company has given a return of about 26.81%, which is very good. It is good.

The company has given good returns to its shareholders for many years, the company is continuously moving towards growth and we can expect to see more similar growth of the company in the coming times.

A continuous increase can be seen in the share price of the company from which it can be estimated that the first target for IRFC Share price target 2023 can be achieved at ₹ 35.10 and the second target can be achieved at ₹ 50.15.

IRFC Share price target 2024

The company is owned by the Government of India, due to which it receives continuous support and the company makes a special contribution to the Railway Department.

The company is continuously moving forward by expanding well through its services and the company has also registered a good growth and the company is continuously working for its expansion.

Due to which the company can be expected to benefit more in the coming time and the first target for IRFC Share price target 2024 can be achieved at ₹ 55 and the second target can be achieved at ₹ 70.

IRFC Share price target 2025

Talking about the market cap of IRFC, it is a large cap company whose market cap is around Rs 41,165.40 Cr. INR and the way the company is continuously growing and expanding,

And it is continuously performing well and increasing its profits, hence the company can be expected to grow further in the coming times.

Considering this, according to our analysis, the first target for IRFC Share price target 2025 can be at ₹75 and the second target can be at ₹90.

IRFC Share price target 2026

The way IRFC company is progressing in its development with full focus on modernization and expansion in the Indian Railway sector and is continuously earning profits from it.

From this, a good strategy of the company can be seen and using this the company is continuously moving towards development and the company can be seen earning good profits continuously.

From which it can be estimated that the company can move forward with its expansion in the coming time and due to which the first target of the company’s IRFC Share price target for 2026 can be ₹ 95 and the second target can be ₹ 110.

IRFC Share price target 2027

IRFC has a strong asset quality, reflecting the high creditworthiness of its customers in the railway and infrastructure sectors. Along with this, the strong credit risk management structure of the company can also be seen,

Which enables it to concentrate and manage its lending activities in a good manner. Thus the company is paying its special attention to every aspect.

Due to which the company is continuously moving towards growth, it can be expected that in the near future, the first target for IRFC Share price target 2027 may be ₹ 115 and the second target may be ₹ 130.

IRFC Share Price Target 2028

IRFC is a wholly owned Government company of the Government of India, due to which it enjoys strong government backing and support. The company has access to government funding, which helps it meet its funding requirements and run its operations smoothly.

This support has also helped the company a lot in maintaining its reputation and credit rating. In this way, the company gets full support from the government, due to which the company is continuously moving forward with good performance, from which it can be estimated that For IRFC Share Price Target 2028, the first target can be at ₹135 and the second target can be at ₹150.

IRFC Share Price Target 2029

Talking about the credit rating of the company, the company has a strong credit rating, IRFC has received strong credit rating from major credit rating agencies like CRISIL, CARE and ICRA. These ratings reflect the strong financial position of the company and the company makes every effort to do so.

So that it can increase the credibility of the company with investors, lenders and other stakeholders. In this way the company tries to build strong relationships with everyone associated with it.

This is also a reason that the company is growing rapidly due to which the company can be expected to develop further in the coming time and with this, the first target for IRFC Share Price Target 2029 is ₹ 155 and the second target is ₹ Could be at 170.

IRFC Share Price Target 2030

If we talk about the landing segment of the company, the company has a diverse portfolio of products, which provides it a good and stable source of income.

The company provides financing for various railway and infrastructure projects including Electrification, Rolling Stock, Track Modernization and Station Development.

In this way, the company earns many different types of profits through these and the company is continuously trying to increase its profits.

Due to which the share price of the company can be expected to increase and better returns in the coming time, due to which the first target for IRFC Share Price Target 2030 can be achieved at ₹ 175 and the second target can be achieved at ₹ 200.

IRFC Share Price Target 2040

The way the company is moving forward by continuously expanding its segments and performing well through its services with the help of the Government of India in the Railway Department, and is continuously striving to improve its customer services.

And with all this, the company is constantly looking for opportunities for its growth by taking advantage of new projects and is making more efforts for its expansion.

Due to this, as the company develops further in the coming time, the share price of the company can be expected to increase and better returns can be expected.

Considering this, according to our analysis, the first target for IRFC Share Price Target 2040 can be at ₹ 400 and the second target at ₹ 450.

Cash Flow Statement Of IRFC

| Y/e 31 Mar ( In .Cr) | — | — | — | — |

|---|---|---|---|---|

| Profit before tax | — | — | — | — |

| Depreciation | — | — | — | — |

| Tax paid | — | — | — | — |

| Working capital | — | — | — | — |

| Other operating items | — | — | — | — |

| Operating cashflow | — | — | — | — |

| Capital expenditure | — | — | — | — |

| Free cash flow | — | — | — | — |

| Equity raised | — | — | — | — |

| Investments | — | — | — | — |

| Debt financing/disposal | — | — | — | — |

| Dividends paid | — | — | — | — |

| Other items | — | — | — | — |

| Net in cash | — | — | — | — |

Profit & Loss Of IRFC

| PROFIT & LOSS ACCOUNT OF INDIAN RAILWAY FINANCE CORPORATION (in Rs. Cr.) | MAR 22 | MAR 21 | MAR 20 | MAR 19 | MAR 18 | |

| 12 mths | 12 mths | 12 mths | 12 mths | 12 mths | ||

| INCOME | ||||||

| REVENUE FROM OPERATIONS [GROSS] | 20,299.26 | 15,770.47 | 13,838.46 | 11,133.59 | 11,018.51 | |

| Less: Excise/Sevice Tax/Other Levies | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| REVENUE FROM OPERATIONS [NET] | 20,299.26 | 15,770.47 | 13,838.46 | 11,133.59 | 11,018.51 | |

| TOTAL OPERATING REVENUES | 20,299.26 | 15,770.47 | 13,838.46 | 11,133.59 | 11,018.51 | |

| Other Income | 2.33 | 0.39 | 0.07 | 0.00 | 1.72 | |

| TOTAL REVENUE | 20,301.60 | 15,770.86 | 13,838.54 | 11,133.60 | 11,020.23 | |

| EXPENSES | ||||||

| Cost Of Materials Consumed | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Purchase Of Stock-In Trade | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Operating And Direct Expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Changes In Inventories Of FG,WIP And Stock-In Trade | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Employee Benefit Expenses | 10.75 | 7.85 | 6.27 | 6.25 | 5.44 | |

| Finance Costs | 14,074.78 | 11,237.05 | 10,079.78 | 8,183.06 | 8,436.85 | |

| Depreciation And Amortisation Expenses | 14.03 | 4.43 | 0.46 | 0.42 | 0.35 | |

| Other Expenses | 111.43 | 102.68 | 57.47 | 14.74 | 32.44 | |

| TOTAL EXPENSES | 14,211.44 | 11,354.73 | 10,146.11 | 8,232.01 | 8,475.08 | |

| PROFIT/LOSS BEFORE EXCEPTIONAL, EXTRAORDINARY ITEMS AND TAX | 6,090.16 | 4,416.13 | 3,692.42 | 2,901.59 | 2,545.15 | |

| Exceptional Items | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| PROFIT/LOSS BEFORE TAX | 6,090.16 | 4,416.13 | 3,692.42 | 2,901.59 | 2,545.15 | |

| TAX EXPENSES-CONTINUED OPERATIONS | ||||||

| Current Tax | 0.00 | 0.00 | 0.00 | 646.92 | 543.42 | |

| Less: MAT Credit Entitlement | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Deferred Tax | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Tax For Earlier Years | 0.32 | 0.00 | 0.00 | -0.09 | -5.58 | |

| TOTAL TAX EXPENSES | 0.32 | 0.00 | 0.00 | 646.84 | 537.84 | |

| PROFIT/LOSS AFTER TAX AND BEFORE EXTRAORDINARY ITEMS | 6,089.84 | 4,416.13 | 3,692.42 | 2,254.75 | 2,007.31 | |

| PROFIT/LOSS FROM CONTINUING OPERATIONS | 6,089.84 | 4,416.13 | 3,692.42 | 2,254.75 | 2,007.31 | |

| PROFIT/LOSS FOR THE PERIOD | 6,089.84 | 4,416.13 | 3,692.42 | 2,254.75 | 2,007.31 | |

| OTHER ADDITIONAL INFORMATION | ||||||

| EARNINGS PER SHARE | ||||||

| Basic EPS (Rs.) | 4.66 | 3.66 | 3.93 | 3.43 | 3.08 | |

| Diluted EPS (Rs.) | 4.66 | 3.66 | 3.93 | 3.43 | 3.08 | |

| VALUE OF IMPORTED AND INDIGENIOUS RAW MATERIALS STORES, SPARES AND LOOSE TOOLS | ||||||

| Imported Raw Materials | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Indigenous Raw Materials | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| STORES, SPARES AND LOOSE TOOLS | ||||||

| Imported Stores And Spares | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Indigenous Stores And Spares | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| DIVIDEND AND DIVIDEND PERCENTAGE | ||||||

| Equity Share Dividend | 1,006.28 | 1,872.19 | 200.00 | 375.00 | 375.00 | |

| Tax On Dividend | 0.00 | 0.00 | 41.11 | 77.09 | 76.69 | |

| Equity Dividend Rate (%) | 14.00 | 11.00 | 2.00 | 4.00 | 6.00 |

Source : Dion Global Solutions Limited,Moneycontrol

Pe Ratio & Book Ratio Of IRFC

| PE Ratio(x) | 6.32 |

| EPS – TTM(₹) | 4.98 |

| MCap(₹ Cr.) | 41,100.45 |

| Sectoral MCap Rank | 2 |

| PB Ratio(x) | 0.96 |

| Div Yield(%) | 4.45 |

| Face Value(₹) | 10.00 |

| Beta | – |

| VWAP(₹) | 31.63 |

| 52W H/L(₹)37.10 / 19.30 |

Source – Economic Times

Company Latest Infra Share News Study

You can easily find the latest infrastructure stock news by searching online news websites or financial news outlets.

Some popular choices include Reuters, Bloomberg, CNBC, and Economic Times.

You may also consider setting up alerts or notifications for news related to Shilpa Medicare Limited or the infrastructure industry,

So that you can stay updated on the latest happenings.

About Investing In IRFC

Before you invest in the shares of Metro Brands or any other company, there is a method of the company,

Investigating and analyzing industry trends requires thorough research and thinking for any investment.

We tell you some points which you can read to ensure your investment:-

Evaluating the company’s financial performance, growth potential and industry trends.

Assessing the company’s management teams and its track record.

Evaluating the competitive position of the company, its financial strengths, weaknesses and looking into the future.

Viewing the company’s valuation and financial metrics that fall short of the company’s value.

If you want to reduce the risk of investment, then you can also go to different companies and by looking at them you can ensure investment.

Current Status Of IRFC

Let us tell you the current status that the growth of this company has gone down which is worrying, you can see this through the live chart provided by us.

Link – LIVE CHART

How To Buy Share

To buy shares of Metro Brands or any other company you have to follow these steps:

Open a Demat Account: A demat account is a type of account where your purchased shares are stored electronically. You can open a Demat account with a bank, financial institution or brokerage firm.

Read Also – TTML Share Price Target 2023,2025,2028,2030,2040

Fund your account: After opening a demat account, you need to deposit money into it to buy shares. You can transfer money to your demat account through net banking or by visiting your bank branch.

Choose a Broker: To buy shares, you need to choose a broker who can execute your trades. You can select a broker based on their reputation, commission fees and other services they provide.

Placing Orders: After choosing a broker, you can place orders to buy shares of Shilpa Medicare Limited through their online trading platform or by calling their customer care.

Keep an eye on your investments: After buying shares, it is important to monitor your investments regularly to stay updated with the company’s performance and market trends.

1.Zerodha

2.Upstox

3.5 paisa

4.Angel Broking

5.ICICI Direct

Expert Opinion On IRFC

Note

The stock forecast/price forecast/target given on our website is only for information and educational purpose for stock market participants/traders/investors.

The content we provide here should not be construed as any financial advice or any other type of advice to invest or trade.

It is important to do your own research and analysis before acting on these comments for any stock as the information is only tentative.

Trading and investing involves high risk, please consult your financial advisor before taking any decision and no responsibility will be taken by Financesharetargets.in for any consequences that may arise from acting on these comments.

THANK YOU FOR VISITING OUR SITE

STAY TUNED…………..