TTML Overview

TTML (Tata Teleservices Maharashtra Limited) is a part of the Tata Group, one of the largest and most respected conglomerates in India. The company was established in 1996,

And its headquarters is in Mumbai, Maharashtra (India). TTML is a leading company providing Connectivity & Communication Solutions services to the customers.

It is exclusively engaged in providing telecommunication services in Maharashtra and Goa circles. The company provides various services including wireless voice and data services, fixed-line broadband and voice services, and enterprise solutions.

TTML provides mobile services under the Tata Docomo brand. It has made its place as one of the leading players in the wireless telecommunication market in Maharashtra and Goa circles.

The company provides 2G, 3G and 4G services to its customers. TTML has a network of over 4,000 cell sites, covering both urban and rural areas, and providing coverage to over 38M customers.

TTML has also been at the forefront of providing Fixed-Line Broadband and Voice services in Maharashtra and Goa. The company provides high-speed broadband services to its customers under the Tata Indicom brand name.

It offers various broadband plans to its customers with different speeds and data limits as per the needs of different customers.

TTML also provides a variety of other facilities to its customers, which include Data Connectivity, Voice Connectivity and Managed Services.

The company also provides various solutions for business including MPLS VPN, Leased Line, Internet Leased Line and Toll-Free Services. TTML’s Enterprise solutions are designed to meet the needs of all types of businesses, small, medium and large.

TTML has a strong focus on innovation and continuously introduces innovative new products and services to meet the growing needs of its customers.

TTML has been recognized for its excellent services and has won many awards and honors over the years. The company has won the ‘Best Telecom Service Provider’ award at the Maharashtra IT Awards for almost three consecutive years. It has also been awarded the ‘Best CDMA Operator’ award at the Telecom Operator Awards.

In 2017, TTML’s parent company Tata Teleservices Limited announced that it would merge with Bharti Airtel Limited. The merger was completed in 2018, and TTML became a wholly owned subsidiary of Bharti Airtel Limited.

As part of the merger, TTML’s mobile customers were transferred to the Airtel network, while its fixed-line broadband and enterprise customers were retained under the TTML brand.

Thus, TTML is operating as a leading telecom service provider in Maharashtra and Goa circle, offering its customers a wide range of services including wireless voice and data services, fixed-line broadband and voice services and enterprise solutions. provides,

And continues to drive its expansion with a strong focus on innovation and introducing new products and services to meet the evolving needs of its customers. TTML has won many awards and recognitions for its excellent services over the years and the company is continuously working towards its growth.

TTML Company’s Business Model

TTML (Tata Teleservices Maharashtra Limited) works on this business model as a Telecom Service Provider, and it provides a variety of telecommunication services to its customers. The company derives its revenue by making profits from different services including voice and data services, enterprise solutions and value-added services.

The first source of revenue for TTML can be said to be its wireless voice and data services. The company provides 2G, 3G and 4G services to its customers under the Tata Docomo brand. TTML has a network of over 4,000 cell sites, covering both urban and rural areas.

And delivers its services covering more than 38 million customers. The company generates revenue through various plans and packages offered to its customers including Prepaid, Postpaid and Data plans.

Along with these, the company also provides different types of Value Added Services, such as music, game and video streaming services, from where additional revenue of the company comes.

TTML also generates revenue through its fixed-line broadband and voice services. The company also provides high-speed broadband services to its customers under the Tata Indicom brand.

It offers different broadband plans with speed and data limits keeping in mind the different needs of the Kala Kala customers.

TTML also earns a good amount of revenue through enterprise solutions. The company also provides different services for businesses including MPLS VPN, Leased Line, Internet Leased Line and Toll-Free Services. TTML’s enterprise solutions provide services to all types of systems.

Apart from the above sources of revenue, TTML also generates revenue through Interconnect Usage Charges (IUC). IUC is a charge that one telecom operator pays for using its network to make calls to another.

TTML also earns revenue from the sale of handsets and devices. The company has tie-ups with various handset manufacturers and sells handsets and devices to its customers at reasonable prices. TTML earns good profits by selling handsets and devices.

TTML’s cost expenditures include network infrastructure expenses, marketing expenses, employee expenses, and administrative expenses. The company incurs significant expenses on network infrastructure, including the costs to install and maintain cell sites and other network equipment.

The company also incurs significant marketing expenses to promote its services and attract new customers. Along with these, the company also spends on employees and administrative areas including rent, utilities and office expenses.

Which is an important part of the cost structure of the company. The company also spends on its offices, utilities, such as electricity and water, and other administrative areas.

Overall, TTML operates on its business model as a telecommunications service provider, providing a variety of related services to its customers.

The company strives to maintain its strong position as a leading telecom service provider in Maharashtra and Goa circles with a strong focus on innovation, quality of services and customer satisfaction.

Basics Of TTML

TTML is an Indian Telecom company. This company is a subsidiary of Tata Group.

Company Name- TATA Teleservices Maharashtra Limited

Year of Establishment- 1995

Headquarters- Mumbai, Maharashtra (India)

The company provides telecom facilities including Voice and Data Services, Enterprise Solutions and Value Added Services to customers mainly in Maharashtra and Goa circles.

TTML provides 2G, 3G and 4G wireless voice and data services to its customers under the Tata Docomo brand. The company has a wide network consisting of more than 4,000 cell sites,

Which caters to both urban and rural areas, and serves over 38M customers. TTML offers many plans to its customers including prepaid, postpaid and data plans.

Overall, the company’s services include Cloud and SaaS, Data Services, Collaboration, Cyber Security, Voice Services and Market Solutions. Along with this, it also provides information and communication technology services to businesses. TTML also provides cyber security.

Whose portfolio includes Email Security, Web Security, Endpoint Security, Multifactor Authentication, and Virtual Firewall. It also provides various Collaboration Solutions & Marketing Solutions,

Like Conferencing, Webcasting Services, International Bridging Services, Toll Free Services, SMS Solutions, OBD Services and Call Register Services. Along with these, it serves small, medium and large business enterprises including manufacturing, education, healthcare, telecommunications, media and entertainment.

Overall it can be said that, TTML is a successful Indian telecom company that provides telecom services to customers in Maharashtra and Goa circle.

And the company is continuously striving for innovation and making its services more quality and as per the requirement of the customers.

Performance Of TTML

Performance of TTML company in words: TTML has been consistently showing mixed performance since its inception. The company has had to face intense competition from other telecom companies in the market and has also had to struggle with high levels of debt. The company’s performance has been reflected in this It can be briefly understood in this way –

In the early years of its operations, TTML was working to establish itself as a leading telecommunications player with a strong focus on innovation and quality of services.

The company also launched various value-added services such as music, game and video streaming services to attract new customers.

In 2008, TTML launched its GSM services under the Tata DoCoMo brand, which was well received by customers.

However, TTML later faced decline around the mid-2010s as competition increased in the telecommunications industry in India.

Especially the entry of new players like Reliance Jio made the market very competitive, which led to a sharp decline in TTML’s revenue. The company also struggled with high levels of debt, which hampered its ability to invest in the network’s infrastructure and technology.

In 2017, TTML announced that it would acquire TTML, one of the largest telecom companies in India, as part of a debt-restructuring plan.

Bharti will merge with Airtel. The merger was completed in 2018 and TTML’s mobile customers were transferred to Airtel’s network. However, TTML continued to offer its Enterprise solutions and fixed-line broadband services under the Tata Indicom brand.

TTML’s performance since the merger has been mixed. The company continues to offer Enterprise solutions and fixed-line broadband services,

But its revenues are still a bit volatile. In the quarter ended December 2022, TTML recorded Total Revenue of approximately 2.84B while

Net income was approximately -2.8B,

One reason for the decline in TTML’s revenue is the rapidly increasing competition in the market. The telecommunications industry in India is full of competition, where companies offer attractive plans and packages to the customers.

The entry of new players like Jio has created a price war in the market, in which companies try to attract customers by offering features like low tariffs.

TTML is also struggling with debt, which has affected its ability to invest in network infrastructure and technology.

Despite these challenges, TTML has continued its growth focusing on innovation and quality of services. The company has launched a variety of services to improve its services and attract new customers.

For example, in 2020, the company launched a new enterprise solutions platform called Smartflow, through which it provides a range of digital services to businesses.

Overall, TTML has had a mixed performance over the years. However, it has struggled with intense market competition and debt in recent years. The merger with Bharti Airtel has helped the company in reducing its debt, but there has not been any significant benefit in its revenue.

TTML continues to focus on innovation and quality of services, and it remains to be seen how the company performs in the years to come. However, the way the company continues to grow, it is expected that the company will continue to grow in the coming years. Can be seen performing well.

Fundamental Analysis Of TTML

Update soon

Share Holders & Holding Pattern Of TTML

| Summary | Mar 2023 | Dec 2022 | Sep 2022 | Jun 2022 | Mar 2022 | Dec 2021 | Sep 2021 | Jun 2021 | Mar 2021 | Dec 2020 | Sep 2020 | Jun 2020 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Promoter | 74.4% | 74.4% | 74.4% | 74.4% | 74.4% | 74.4% | 74.4% | 74.4% | 74.4% | 74.4% | 74.4% | 74.4% |

| Holding | 74.4% | 74.4% | 74.4% | 74.4% | 74.4% | 74.4% | 74.4% | 74.4% | 74.4% | 74.4% | 74.4% | 74.4% |

| Pledged | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% |

| Locked | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% |

| BE | 2.2% | 2.2% | 2.3% | 2.3% | 1.6% | 0.8% | 0.2% | 0.0% | 0.0% | 0% | 0% | 0% |

| DII | 0.0% | 0.0% | 0.1% | 0.0% | 0% | 0.0% | 0% | 0% | 0% | 0% | 0% | 0% |

| Public | 23.4% | 23.4% | 23.3% | 23.3% | 24.1% | 24.8% | 25.5% | 25.6% | 25.6% | 25.6% | 25.6% | 25.6% |

| Others | 0.0% | 0.0% | 0.0% | 0.0% | 0% | 0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% |

Source – Trendlyne

Shareholding-pattern-as-on-March-31-2023Download

Services Given By TTML

Update Soon

Share Price History Of TTML

Update Soon

Similar Stocks Of TTML

| Name | Last Price | Market Cap. (Rs. cr.) | Sales Turnover | Net Profit | Total Assets |

| Bharti Airtel | 760.25 | 431,305.53 | 70,641.90 | -3,625.00 | 182,337.90 |

| Vodafone Idea | 6.35 | 30,911.60 | 38,220.70 | -28,237.20 | 129,637.70 |

| TataTeleservice | 62.75 | 12,267.17 | 1,106.17 | -1,144.72 | 871.36 |

| MTNL | 18.90 | 1,190.70 | 1,069.72 | -2,602.59 | 7,950.02 |

| Reliance Comm | 1.40 | 387.17 | 345.00 | -5,617.00 | -3,516.00 |

| Accord Synergy | 22.50 | 7.81 | 24.96 | -5.93 | 15.77 |

Source – Moneycontrol

History Of TTML

Update Soon

Net Worth Of TTML

Market capitalization TTML is ₹122.55 Billion.

Income Statement Analysis Of TTML

Valuation Of TTML(You Can Click On Chart For live)

Vision & Value Of TTML

Update soon

Products Of TTML

Update Soon

Competitor Comparision Of TTML

| Stock | FY PE Ratio | PB Ratio | Dividend Yield |

|---|---|---|---|

| Tata Teleservices (Maharashtra) Ltd | -10.66 | -0.65 | — |

| Bharti Airtel Ltd | 103.78 | 4.80 | 0.40% |

| Tata Communications Ltd | 20.07 | 36.99 | 1.69% |

| Vodafone Idea Ltd | -1.11 | -0.51 | — |

source – economictimes

Speciality Of TTML In Its Sector

Update soon

Revenue Distribution By Sectors Of TTML

Update soon

Balance Sheet Analysis Of TTML

| BALANCE SHEET OF TATA TELESERVICES (MAHARASHTRA) (in Rs. Cr.) | MAR 22 | MAR 21 | MAR 20 | MAR 19 | MAR 18 | |

| 12 mths | 12 mths | 12 mths | 12 mths | 12 mths | ||

| EQUITIES AND LIABILITIES | ||||||

| SHAREHOLDER’S FUNDS | ||||||

| Equity Share Capital | 1,954.93 | 1,954.93 | 1,954.93 | 1,954.93 | 1,954.93 | |

| TOTAL SHARE CAPITAL | 1,954.93 | 1,954.93 | 1,954.93 | 1,954.93 | 1,954.93 | |

| Reserves and Surplus | -25,795.43 | -24,580.25 | -22,585.01 | -18,813.58 | -18,138.85 | |

| TOTAL RESERVES AND SURPLUS | -25,795.43 | -24,580.25 | -22,585.01 | -18,813.58 | -18,138.85 | |

| TOTAL SHAREHOLDERS FUNDS | -23,840.50 | -22,625.32 | -20,630.08 | -16,858.65 | -16,183.92 | |

| NON-CURRENT LIABILITIES | ||||||

| Long Term Borrowings | 10,710.81 | 9,868.86 | 6,138.44 | 5,708.33 | 7,862.21 | |

| Deferred Tax Liabilities [Net] | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Other Long Term Liabilities | 62.34 | 119.23 | 172.97 | 0.00 | 0.00 | |

| Long Term Provisions | 0.46 | 2.75 | 4.57 | 1.86 | 124.21 | |

| TOTAL NON-CURRENT LIABILITIES | 10,773.61 | 9,990.84 | 6,315.98 | 5,710.19 | 7,986.42 | |

| CURRENT LIABILITIES | ||||||

| Short Term Borrowings | 8,993.03 | 3,090.55 | 4,338.14 | 6,931.10 | 5,306.44 | |

| Trade Payables | 224.21 | 264.37 | 291.07 | 196.96 | 482.19 | |

| Other Current Liabilities | 149.47 | 6,598.47 | 6,381.24 | 6,457.06 | 3,873.34 | |

| Short Term Provisions | 56.69 | 55.63 | 1,866.94 | 126.81 | 890.92 | |

| TOTAL CURRENT LIABILITIES | 9,423.40 | 10,009.02 | 12,877.39 | 13,711.93 | 10,552.89 | |

| TOTAL CAPITAL AND LIABILITIES | 1,364.53 | 1,508.98 | 1,714.21 | 4,602.29 | 3,380.16 | |

| ASSETS | ||||||

| NON-CURRENT ASSETS | ||||||

| Tangible Assets | 776.77 | 827.51 | 891.01 | 675.17 | 793.66 | |

| Intangible Assets | 2.33 | 2.61 | 2.75 | 42.90 | 53.27 | |

| Capital Work-In-Progress | 28.16 | 29.30 | 39.18 | 26.31 | 26.59 | |

| Other Assets | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| FIXED ASSETS | 807.26 | 859.42 | 932.94 | 744.38 | 873.52 | |

| Non-Current Investments | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Deferred Tax Assets [Net] | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Long Term Loans And Advances | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Other Non-Current Assets | 179.00 | 161.89 | 185.65 | 340.07 | 622.05 | |

| TOTAL NON-CURRENT ASSETS | 986.26 | 1,021.31 | 1,118.59 | 1,084.45 | 1,495.57 | |

| CURRENT ASSETS | ||||||

| Current Investments | 100.50 | 70.23 | 0.00 | 608.63 | 377.79 | |

| Inventories | 0.00 | 0.00 | 0.00 | 0.00 | 0.13 | |

| Trade Receivables | 52.40 | 78.22 | 121.72 | 162.51 | 157.88 | |

| Cash And Cash Equivalents | 17.02 | 43.29 | 84.53 | 171.13 | 39.16 | |

| Short Term Loans And Advances | 0.00 | 0.00 | 0.00 | 3.74 | 16.15 | |

| OtherCurrentAssets | 208.35 | 295.93 | 389.37 | 2,571.83 | 1,293.48 | |

| TOTAL CURRENT ASSETS | 378.27 | 487.67 | 595.62 | 3,517.84 | 1,884.59 | |

| TOTAL ASSETS | 1,364.53 | 1,508.98 | 1,714.21 | 4,602.29 | 3,380.16 | |

| OTHER ADDITIONAL INFORMATION | ||||||

| CONTINGENT LIABILITIES, COMMITMENTS | ||||||

| Contingent Liabilities | 952.63 | 638.18 | 893.92 | 3,056.57 | 1,075.70 | |

| CIF VALUE OF IMPORTS | ||||||

| Raw Materials | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Stores, Spares And Loose Tools | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Trade/Other Goods | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Capital Goods | 45.00 | 47.92 | 68.39 | 119.72 | 38.76 | |

| EXPENDITURE IN FOREIGN EXCHANGE | ||||||

| Expenditure In Foreign Currency | 1.55 | 0.30 | 1.68 | 2.97 | 107.67 | |

| REMITTANCES IN FOREIGN CURRENCIES FOR DIVIDENDS | ||||||

| Dividend Remittance In Foreign Currency | — | — | — | — | — | |

| EARNINGS IN FOREIGN EXCHANGE | ||||||

| FOB Value Of Goods | — | — | — | — | — | |

| Other Earnings | — | — | 0.12 | 0.31 | 2.95 | |

| BONUS DETAILS | ||||||

| Bonus Equity Share Capital | 57.73 | 57.73 | 57.73 | 57.73 | 57.73 | |

| NON-CURRENT INVESTMENTS | ||||||

| Non-Current Investments Quoted Market Value | — | — | — | — | — | |

| Non-Current Investments Unquoted Book Value | — | — | — | — | — | |

| CURRENT INVESTMENTS | ||||||

| Current Investments Quoted Market Value | 100.50 | 70.23 | — | — | — | |

| Current Investments Unquoted Book Value | — | — | — | — | — |

Source : Dion Global Solutions Limited, MoneyControl

Annual Reports Of TTML

27th-Annual-Report-for-FY-2021-2022Download

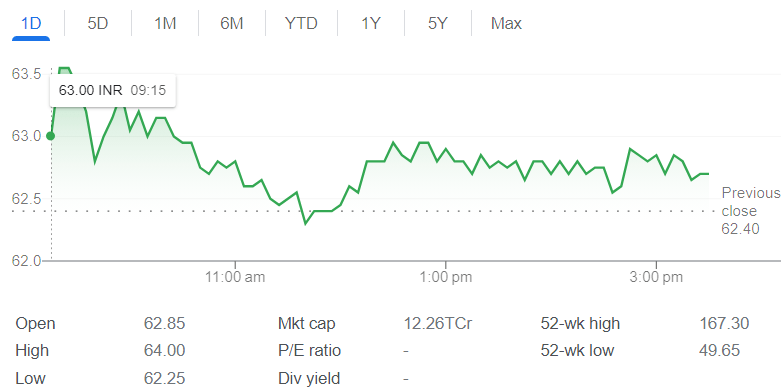

TTML Share Price Today Live Chart

TTML Business Analysis

Financial Strength TTML

Update soon

TTML Share Price Target 2023, 2024, 2025, 2026, 2027, 2028, 2029, 2030,2040

TTML Share price target 2023, 2024, 2025, 2026, 2027, 2028, 2029, 2030,2040

We here at financesharetargets. in is going to give you estimated information about stock predictions, price predictions and targets for 2023, 2024, 2025, 2026, 2027, 2028, 2029, 2030 and 2040.

Please keep one thing in mind that this forecast, prediction or any target is only a suggestion given by our analysis. It is almost impossible for any forecast/prediction to be correct.

Errors are always present in any analysis, but we try our best to give you good price stock forecasts/predictions.

TTML Share Price Target 2023

If we look at the share price of TTML on NSE, the company has given a return of about 18.75% since the last week of April. If we look at the returns of the last 5 years, the company has given a return of about 1031.77%.

Which is very good, the company has given good returns to its shareholders for many years continuously and the company is continuously moving towards development in the same manner.

And a continuous increase can be seen in the share price of the company from which it can be estimated that the first target for TTML share price target 2023 can be achieved at ₹ 65 and the second target can be achieved at ₹ 90.

TTML Share Price Target 2024

TTML is a part of the Tata Group which is one of the largest and most respected conglomerates in India. The company has a reason and respect for itself.

And the company is a leading company as a telecom service provider and the company is continuously working through its different aspects and is seen continuously moving towards its development.

Due to which, with the further development of the company in the coming time, the first target for TTML share price target 2024 can be achieved at ₹ 95 and the second target can be achieved at ₹ 120.

TTML Share Price Target 2025

The company is a good and growing company. If we talk about the market cap of the company, it is a mid cap company with around INR 12250 crores and the company continuously provides various types of services for its growth.

And with all this, the company is continuously moving forward by developing its services keeping in mind the needs of the customers.

In such a situation, good returns can be expected with the increase in the share price of the company in the coming time, seeing this, according to our analysis, TTML share price target 2025, the first target can be at ₹ 125 and the second target can be at ₹ 150.

TTML Share Price Target 2026

TTML is continuously moving forward by developing its services. The company provides 2G, 3G and 4G wireless voice and data services to its customers under the Tata DoCoMo brand.

This brand of the company is very much liked by the customers. In this way, the company is continuously moving ahead by developing itself as per the time and customer’s requirement. Due to which, in the coming time, the first target for TTML share price target 2026 can be ₹ 155 and the second target can be ₹ 180.

TTML Share Price Target 2027

The company has a wide network through which the company provides its products and services to 38M customers, and runs an optical fiber transmission network of over 16,000 kilometers across Maharashtra and Goa.

In this way, the company has a large network and as the time is rapidly moving towards 5G, the use of 5G technology optical fiber can benefit the company.

And the way the company has brought itself towards development by updating itself till now, some kind of development can be expected in future also and from this it can be estimated,

That for TTML share price target 2027, the first target can be at ₹ 185 and the second target can be at ₹ 210.

TTML Share Price Target 2028

As TTML is part of the Tata Group, the Tata Group enjoys a strong reputation in India, which TTML seems to be taking great advantage of. The Tata brand continues to improve with its high ethical standards, attention to customer needs and innovative products. Known for better services.

TTML leverages the Tata brand to build trust and credibility among customers and stakeholders. This is a feature of the company that helps in attracting more and more customers like the company. Thus the company has a strong brand presence. is

From which it can be expected that in the coming time, the company can move ahead taking advantage of this, due to which the first target for TTML share price target 2028 can be achieved at ₹ 215 and the second target at ₹ 240 along with the company’s profit. |

TTML Share Price Target 2029

TTML is also continuously working towards bringing digital transformation in India for which the company has launched several initiatives to promote digital inclusion and accessibility. The company’s flagship digital initiative, Tata Docomo Business Services, offers a range of digital services for businesses including cloud computing, IoT and security services.

With a strong focus on innovation and development, TTML is increasingly looking forward to emerging technologies such as 5G, AI and Blockchain.

Due to which the company can be expected to grow further and its profits in the near future, and due to which the first target for TTML share price target 2029 can be at ₹ 245 and the second target can be at ₹ 270.

TTML Share Price Target 2030

As the company focuses on providing superior customer service, it has also invested in building a strong customer support base and has set up a dedicated call centre,

And the way TTML has adopted the customer-centric approach and has continuously worked to build strong relationships with its customers and increase customer satisfaction.

It can be understood that the company is rapidly moving towards its development, due to which the company can earn more profits in the coming time, due to which the share price of the company will increase along with the profits and better returns can be expected.

Considering this, according to our analysis, the first target for TTML share price target 2030 can be at ₹275 and the second target can be at ₹300.

TTML Share Price Target 2040

The way TTML is continuously moving towards its development as per the changing needs of the customers and the demand of time through its large network and high quality services.

And is working to add new services to its portfolio and is constantly trying to develop itself through all this.

Due to this, as the company develops further in the coming time, the share price of the company can be expected to increase and better returns can be expected.

In view of this, according to our analysis, the first target for TTML share price target 2040 can be achieved at ₹ 550 and the second target can be achieved at ₹ 600.

Cash Flow Statement Of TTML

| CASH FLOW OF TATA TELESERVICES (MAHARASHTRA) (in Rs. Cr.) | MAR 22 | MAR 21 | MAR 20 | MAR 19 | MAR 18 | |

| 12 mths | 12 mths | 12 mths | 12 mths | 12 mths | ||

| NET PROFIT/LOSS BEFORE EXTRAORDINARY ITEMS AND TAX | -1,215.00 | -1,996.69 | -3,714.11 | -667.60 | -9,841.99 | |

| Net CashFlow From Operating Activities | 532.40 | 567.22 | -359.72 | -745.50 | 613.03 | |

| Net Cash Used In Investing Activities | -131.84 | -176.52 | 510.12 | -101.49 | 249.13 | |

| Net Cash Used From Financing Activities | -426.87 | -432.22 | -237.00 | 967.35 | -516.42 | |

| Foreign Exchange Gains / Losses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Adjustments On Amalgamation Merger Demerger Others | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| NET INC/DEC IN CASH AND CASH EQUIVALENTS | -26.31 | -41.52 | -86.60 | 120.36 | 345.74 | |

| Cash And Cash Equivalents Begin of Year | 43.01 | 84.53 | 171.13 | 39.07 | -361.65 | |

| Cash And Cash Equivalents End Of Year | 16.70 | 43.01 | 84.53 | 159.43 | -15.91 |

Source : Dion Global Solutions Limited,Moneycontrol

Profit & Loss Of TTML

| ROFIT & LOSS ACCOUNT OF TATA TELESERVICES (MAHARASHTRA) (in Rs. Cr.) | MAR 22 | MAR 21 | MAR 20 | MAR 19 | MAR 18 | |

| 12 mths | 12 mths | 12 mths | 12 mths | 12 mths | ||

| INCOME | ||||||

| REVENUE FROM OPERATIONS [GROSS] | 1,078.82 | 1,023.98 | 1,052.62 | 1,246.40 | 1,852.76 | |

| Less: Excise/Sevice Tax/Other Levies | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| REVENUE FROM OPERATIONS [NET] | 1,078.82 | 1,023.98 | 1,052.62 | 1,246.40 | 1,852.76 | |

| TOTAL OPERATING REVENUES | 1,093.80 | 1,043.66 | 1,077.74 | 1,277.20 | 1,878.12 | |

| Other Income | 11.46 | 24.10 | 34.52 | 38.38 | 35.49 | |

| TOTAL REVENUE | 1,105.26 | 1,067.76 | 1,112.26 | 1,315.58 | 1,913.61 | |

| EXPENSES | ||||||

| Cost Of Materials Consumed | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Purchase Of Stock-In Trade | 0.00 | 0.00 | 0.00 | 0.63 | 2.31 | |

| Operating And Direct Expenses | 497.12 | 442.57 | 504.07 | 0.00 | 0.00 | |

| Changes In Inventories Of FG,WIP And Stock-In Trade | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Employee Benefit Expenses | 55.04 | 49.37 | 59.12 | 64.79 | 103.00 | |

| Finance Costs | 1,536.50 | 1,561.14 | 1,545.07 | 1,553.05 | 1,568.97 | |

| Depreciation And Amortisation Expenses | 160.21 | 168.73 | 194.98 | 177.58 | 532.91 | |

| Other Expenses | 71.39 | 62.83 | 92.85 | 923.86 | 1,450.92 | |

| TOTAL EXPENSES | 2,320.26 | 2,284.64 | 2,396.09 | 2,314.29 | 3,813.93 | |

| PROFIT/LOSS BEFORE EXCEPTIONAL, EXTRAORDINARY ITEMS AND TAX | -1,215.00 | -1,216.88 | -1,283.83 | -998.71 | -1,900.32 | |

| Exceptional Items | 0.00 | -779.81 | -2,430.28 | 331.11 | -7,941.67 | |

| PROFIT/LOSS BEFORE TAX | -1,215.00 | -1,996.69 | -3,714.11 | -667.60 | -9,841.99 | |

| TAX EXPENSES-CONTINUED OPERATIONS | ||||||

| Current Tax | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Less: MAT Credit Entitlement | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Deferred Tax | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Tax For Earlier Years | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| TOTAL TAX EXPENSES | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| PROFIT/LOSS AFTER TAX AND BEFORE EXTRAORDINARY ITEMS | -1,215.00 | -1,996.69 | -3,714.11 | -667.60 | -9,841.99 | |

| PROFIT/LOSS FROM CONTINUING OPERATIONS | -1,215.00 | -1,996.69 | -3,714.11 | -667.60 | -9,841.99 | |

| PROFIT/LOSS FOR THE PERIOD | -1,215.00 | -1,996.69 | -3,714.11 | -667.60 | -9,841.99 | |

| OTHER ADDITIONAL INFORMATION | ||||||

| EARNINGS PER SHARE | ||||||

| Basic EPS (Rs.) | -6.22 | -10.21 | -19.00 | -3.41 | -50.34 | |

| Diluted EPS (Rs.) | -6.22 | -10.21 | -19.00 | -3.41 | -50.34 | |

| VALUE OF IMPORTED AND INDIGENIOUS RAW MATERIALS STORES, SPARES AND LOOSE TOOLS | ||||||

| Imported Raw Materials | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Indigenous Raw Materials | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| STORES, SPARES AND LOOSE TOOLS | ||||||

| Imported Stores And Spares | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Indigenous Stores And Spares | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| DIVIDEND AND DIVIDEND PERCENTAGE | ||||||

| Equity Share Dividend | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Tax On Dividend | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Equity Dividend Rate (%) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

Source : Dion Global Solutions Limited,MoneyControl

Pe Ratio & Book Ratio Of TTML

Key Metrics

| PE Ratio(x) | -10.68 |

| EPS – TTM(₹) | -5.87 |

| MCap(₹ Cr.) | 12,267.17 |

| Sectoral MCap Rank | 6 |

| PB Ratio(x) | -0.65 |

| Div Yield(%) | 0.00 |

| Face Value(₹) | 10.00 |

| Beta | 1.12 |

| VWAP(₹) | 62.97 |

| 52W H/L(₹)178.70 / 49.65 |

Source – Economictimes

Company Latest Infra Share News Study

You can easily find the latest infrastructure stock news by searching online news websites or financial news outlets.

Some popular choices include Reuters, Bloomberg, CNBC, and Economic Times.

You may also consider setting up alerts or notifications for news related to Shilpa Medicare Limited or the infrastructure industry,

So that you can stay updated on the latest happenings.

About Investing In TTML

Before you invest in the shares of TTML or any other company, there is a method of the company,

Investigating and analyzing industry trends requires thorough research and thinking for any investment.

We tell you some points which you can read to ensure your investment:-

Evaluating the company’s financial performance, growth potential and industry trends.

Assessing the company’s management teams and its track record.

Evaluating the competitive position of the company, its financial strengths, weaknesses and looking into the future.

Viewing the company’s valuation and financial metrics that fall short of the company’s value.

If you want to reduce the risk of investment, then you can also go to different companies and by looking at them you can ensure investment.

Current Status Of Company

Let us tell you the current status that the growth of this company has gone down which is worrying, you can see this through the live chart provided by us.

Link – LIVE CHART

How To Buy Share

To buy shares of TTML or any other company you need to follow these steps:

Open a Demat Account: A demat account is a type of account where your purchased shares are stored electronically. You can open a Demat account with a bank, financial institution or brokerage firm.

Fund your account: After opening a demat account, you need to deposit money into it to buy shares. You can transfer money to your demat account through net banking or by visiting your bank branch.

Choose a Broker: To buy shares, you need to choose a broker who can execute your trades. You can select a broker based on their reputation, commission fees and other services they provide.

Placing Orders: After choosing a broker, you can place orders to buy shares of Shilpa Medicare Limited through their online trading platform or by calling their customer care.

Keep an eye on your investments: After buying shares, it is important to monitor your investments regularly to stay updated with the company’s performance and market trends.

1.Zerodha

2.Upstox

3.5 paisa

4.Angel Broking

5.ICICI Direct

Expert Opinion On TTML

Note

The stock forecast/price forecast/target given on our website is only for information and educational purpose for stock market participants/traders/investors.

The content we provide here should not be construed as any financial advice or any other type of advice to invest or trade.

It is important to do your own research and analysis before acting on these comments for any stock as the information is only tentative.

Trading and investing involves high risk, please consult your financial advisor before taking any decision and no responsibility will be taken by Financesharetargets.in for any consequences that may arise from acting on these comments.

Read Also – HAL Share Price Target 2023,2025,2028,2030,2040|Earn

Read Also – Asian Paints Share Price Target 2023,2025,2028,2030,2040

Read Also – Metro Brands Share Price Target 2023,2024,2025,2028,2030,2040|Earn

THANK YOU FOR VISITING OUR SITE

STAY TUNED…………..