Shilpa Medicare Company Overview :-

Shilpa Medicare Company is an Indian medicine manufacturing company that specializes in active pharmaceutical ingredients and formulations.

This company was founded in 1987 by Mr. It was established by Vishnukant C.Bhutada, the head quarter of this company is located in Karnataka India.

Many APIs are being worked on by Shilpa Medicare. This company deals with ONCOLOGY, GASTRIC, CARDIOLOGY CMS CENTRAL NERVOUS SYSTEM AND KIDNEY,

This company is working on formulations related to NEPHROLOGY. The API of this company is more than 300 in gastro and nephrology and it has more than 180 formulations.

This company exports its products to more than 70 countries. This company provides contract research to multinational and domestic pharmaceuticals. This company has made its place even stronger in oncology.

This company is ensuring its investment on companies with different products. Shilpa Medicare Company is working on market research and different strategies to increase its expansion in the market.

Shilpa Medicare Company has become a big player in the pharmaceutical industry and its track record is well established.

Business Model

Shilpa Medicare Company works in a business model. This company works on things related to pharmaceutical i.e. medicines. Its business model ranges from pharmaceutical chain, research, development to manufacturing and marketing.

The main objective of this company is only on pharmaceutical industry, especially on API and formulations. Under this, everything from cancer drugs to generic medicines is sold in India and abroad outside India.

Shilpa Medicare Company provides its services to other similarly stressed companies so that the company is able to manufacture its own goods and sell them in the market.

Shilpa Medicare Company provides services to these companies like development analysis, development stability study and clinical trials.

This company has a team of more than 300 scientists who always pay attention to new medicines and therapeutics.

To make Shilpa Medicare Company a global company, good systems and good marketing are done by this company, due to which it has become a global company.

Shilpa Medicare Company is certified by US FDA and CMA and PMDA gas agencies. Overall, Shilpa Medicare’s model is based on best-in-class medicine quality and global reach.

Basics Of Shilpa Medicare:-

It allows other companies like it to specialize in manufacturing their own goods.

The differentiated product portfolio is over 300 different APIs and over 180 plus formulations.

The company has a strong global presence in the pharmaceutical industry.

Shilpa Medicare Company is traded on BSE & NSE.

Performance Of Shilpa Medicare

Shilpa Medicare Company has recently started its expansion globally and the growth of this company has accelerated in recent years. Which company’s performance is very strong?

The performance of the company is given in the following:-

Revenue – The revenue of Shilpa Medicare Company has increased continuously till 2022. If seen according to the financial year 2022, it has decreased by 11 percent.

Which is questionable, in the year 2021, the share of Shilpa Company was bigger than it but by the time of 2022, there has been a sudden downfall which is natural.

Profit – According to the profitability of this company 2022, it is running at a loss of 2 points of ₹15. Its profit was 2 points of ₹45 in the year 2022 but it is incurring a huge loss in 2023.

Research and Development —— Shilpa Medicare Company is continuously investing in research and development. This company is therefore investing in its development.

Because with this it becomes necessary for its new medicines and the medicines it is selling and can cure diseases well.

Global Presence —- This company has a very strong global presence. This company installs products in more than 70 countries.

Fundamental Analysis Of Shilpa Medicare

Profitability – The revenue growth of this company was very good in the last few years but if we talk about 2023, this company is running in loss of about 2 points at ₹15 per share.

Revenue Growth —- The annual profit growth of this company was very high in the last 3 to 4 years but its revenue growth has dropped to 11% in 2023. This is 11% CGR.

David to Equity – As of March 2023, this company has no debt-to-equity ratio at all.

ROE —- The rising ROE of this company is 7.7 percent, the rising is less than last 3 years due to which it can also be seen that this company may be lower as compared to its peers.

Overall, this company is fundamentally strong. Some ups and downs are common in companies. The company’s focus on R&D and regular dividend payment also indicates long-term growth.

Share Holders Of Shilpa Medicare Centre

The following are the shareholders of Shilpa Medicare Limited as of December 31, 2021:-

S Ramesh Babu – 11.25 percent

Life Insurance Corporation of India 10.91 percent

Vanguard Emerging Market Stock Index Fund 1.72 percent

Nomura India Investment Fund Mother Fund 1.67 percent

Societe Generale ODI 1.29 percent

HUF of the promoter family 1.14 percent

HDFC Trustee Company Limited- AC HDFC Capital Builder Fund 1.13%

Fidelity Emerging Markets Fund 1.2 percent

SBI Small Cap Fund 0.99 percent

Goldman Sachs India Fund Limited 0.98 percent

Let us tell you that the shareholder name pattern given by us may change with time.

Please search the names given by us thoroughly and generate your results. The figures given by us may be different also. Please do not take it as true, do your research.

READ THIS ARTICLE ALSO – Morepen Lab Share Price Target

Services Given By Shilpa Medicare Ltd.

There are many types of services available by Shilpa Medicare Company which you can use. Following are some of the services provided by the company:-

Contract Manufacturing :- Shilpa Medicare Company works to manufacture medicines by taking contracts from other pharmaceutical companies.

This company provides its facilities keeping in mind the international quality. This company can manufacture a wide range of APIs, finished dosage forms and biologics.

Research and Development :- A special focus of this company is engaged in research and development work, this company attracts many investors in this field.

So that its products can grow further and perform better at the global level, it also works to improve its existing systems.

To achieve even better growth, the company works on new technology, process optimization and new formulations.

Regulatory Service :- This company ensures its services to foreign countries considering the rules made by them. It helps in getting regulatory approvals from different countries for the product.

Marketing and Distribution :- Shilpa Medicare Company sends its products to the Indian market only and also sells it internationally.

It has a strong presence in oncology. The company also offers a range of products such as Formulation API and Bio Logic,

If seen, this company provides services to a very wide range of pharmaceutical industry.

As things like research and development, contract research, regulatory service, marketing and distribution etc. come under it, this company is engaged in expanding its service further so that it can grow even more and produce bigger products.

Share Holding Pattern Of Shilpa Medicare

As of December 31, 2021, the shareholding pattern of Shilpa Medicare Limited is as follows:

originator

S.B. Shetty & Family: 35.70%

S Ramesh Babu: 11.25%

S.B. Shetty HUF: 1.14%

S Ramesh Babu HUF: 0.16%

Total promoter holding: 48.25%

Institute:

Life Insurance Corporation of India: 10.91%

Vanguard Emerging Markets Stock Index Fund: 1.72%

Nomura India Investment Fund Mother Fund: 1.67%

Societe Generale-ODI: 1.29%

HDFC Trustee Company Limited – A/c HDFC Capital Builder Fund: 1.13%

Goldman Sachs India Fund Ltd: 0.98%

UTI Equity Fund: 0.81%

SBI Magnum Tax Gain Scheme: 0.65%

Aditya Birla Sun Life Equity Fund: 0.64%

Franklin India Small Companies Fund: 0.62%

Total holding institutions: 20.62%

Non-Entities:

General public: 18.12%

Foreign Portfolio Investors: 5.51%

Central Government / State Government / President of India: 0.50%

Total non-institution holding: 24.13%

The above figures may be subject to change based on subsequent disclosures by the company or regulatory changes.

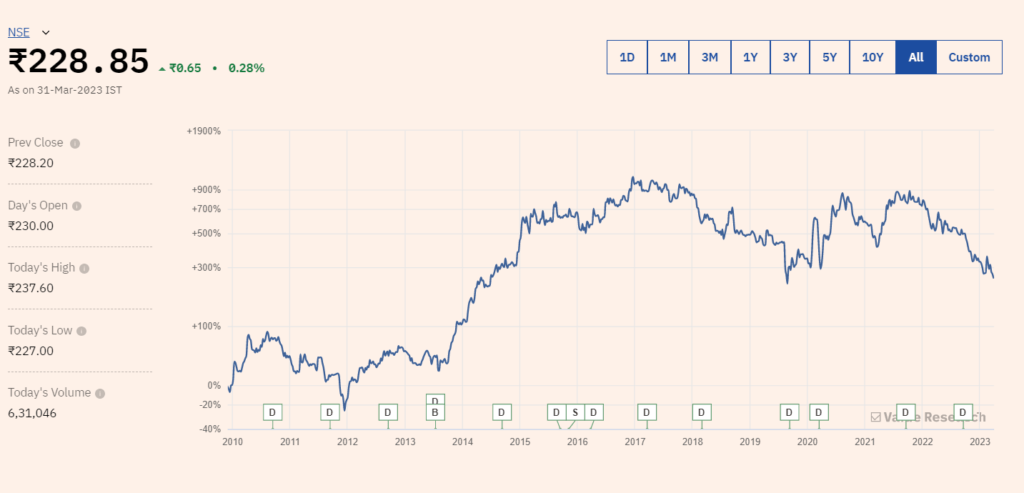

History Of Shilpa Medicare Ltd. Share Price

The last five years share price history of Shilpa Medicare Limited is as follows:

As of March 31, 2018: INR 426.55

As of March 31, 2019: INR 420.05

As of March 31, 2020: INR 272.25

As of March 31, 2021: INR 538.10

By March 31, 2022: INR 369.95

It is important to note that share price can be affected by various factors such as company performance, industry trends, economic conditions and market sentiment.

Therefore, past performance is not necessarily an indicator of future performance, and investors should do their own research and analysis before making investment decisions.

Here are some companies that operate in the same industry as Shilpa Medicare Limited:

- Biocon Limited

- Dr. Reddy’s Laboratories Limited

- Aurobindo Pharma Limited

- Lupine Limited

- Cadila Healthcare Limited

- Sun Pharmaceutical Industries Limited

- Cipla Limited

- Torrent Pharmaceuticals Ltd

- Glenmark Pharmaceuticals Limited

- Divi’s Laboratories Ltd.

It is important to note that while these companies operate in a similar industry, their business models, product offerings, and market capitalization may differ.

Therefore, investors should do their own research and analysis before taking investment decisions.

Net Worth of Shilpa Medicare Ltd.

As per 30 September 2021, the total assets of Shilpa Medicare Company Limited are Rs 1935 crores. It is important for you to note that the total assets and total liabilities of the company depend on the performance of the company, business operation and financial management.

This Information will be update soon.

Income Statement Analysis Of Shilpa Medicare Ltd.

Income Statement of Shilpa Medicare Limited as of March 31, 2022 We are

Revenue – According to the year 2022, this company has earned Rs 1168 crore in a year,

If we look at it, it has increased manifold compared to last year, this is only the performance of API and formulation segment.

Cost of Goods Sold:-

| ACCORDING TO YEAR 2022 | |||||

| INCOME: 12Months | |||||

| Sales Turnover | 356.95 | ||||

| Excise Duty | .00 | ||||

| NET SALES | 356.95 | ||||

| Other Income | 40.8620 | ||||

| TOTAL INCOME | 397.81 | ||||

| EXPENDITURE: | |||||

| Manufacturing Expenses | 17.47 | ||||

| Material Consumed | 78.79 | ||||

| Personal Expenses | 110.57 | ||||

| Selling Expenses | 5.45 | ||||

| Administrative Expenses | 122.99 | ||||

| Expenses Capitalised | .00 | ||||

| Provisions Made | .00 | ||||

| TOTAL EXPENDITURE | 335.27 | ||||

| Operating Profit | 21.69 | ||||

| EBITDA | 62.55 | ||||

| Depreciation | 34.82 | ||||

| Other Write-offs | .00 | ||||

| EBIT | 27.73 | ||||

| Interest | 9.05 | ||||

| EBT | 18.68 | ||||

| Taxes | 7.33 | ||||

| Profit and Loss for the Year | 11.35 | ||||

| Non Recurring Items | 129.64 | ||||

| Other Non Cash Adjustments | .00 | ||||

| Other Adjustments | .00 | ||||

| REPORTED PAT | 140.99 | ||||

| KEY ITEMS | |||||

| Preference Dividend | .00 | ||||

| Equity Dividend | 8.97 | ||||

| Equity Dividend (%) | 103.31 | ||||

| Shares in Issue (Lakhs) | 868.02 | ||||

| EPS – Annualised (Rs) | 16.24 | ||||

Table Credit – Economics Times

Operating Expenses: Total operating expenses for the year stood at Rs 294.14 crore, an increase of 7.6% over the previous year. The increase in operating expenses was primarily due to an increase in personnel and other expenses.

Operating Profit : Operating profit for the full year was Rs 191.18 crore, showing a growth of 83.4% over the previous year. Operating margin for the full year was 16.2%, an improvement of 6.6 percentage points from the previous year.

Other Income: Other income for the year declined 48.9% year-on-year to Rs1.274 billion. The decrease in other income was mainly due to decline in interest income.

Net Profit: Net profit for the year 2023 was INR 174.68 crore, showing a growth of 95.8% over the previous year. Full year net profit margin was 14.8%, an improvement of 7.5 percentage points from the previous year.

Overall, the company’s income statement reflected strong revenue, gross and net income growth driven by a combination of operating efficiencies and strong performance in the API and Formulations segments.

Shilpa Medicare Ltd. Vision & Value

Shilpa Medicare Limited’s vision is to rise to the global level in the field of pharmaceuticals by continuously improving its quality and services while adding value to its stakeholders.

The company’s value goal objective is to achieve this creation with excellence and continuous improvement by focusing on innovation technology and positioning.

About Values Shilpa Medicare Limited commits itself to maintaining high standards of ethical transparency and social responsibility.

The quality values of the company include that it is committed to strictly adhere to the quality standards to provide products and services with high quality to its customers.

The same company, from its product development to manufacturing and detailing, advances all its products with a new design and perfect quality.

The company is committed to reducing its impact on the environment throughout its operations and also plays an important role in the society.

It is committed to the communities in which it operates through social and environmental initiatives.

Products Of Shilpa Medicare

Shilpa Medicare Limited Company is a pharmaceutical company engaged in manufacturing and distribution of a wide range of Generic Active Pharmaceutical Ingredients API Intermediates of Formulations.

The API products produced by the company include anticancer drugs, antiretroviral drugs, immunosuppressants and cardiovascular drugs.

Shilpa Medicare Limited produces various types of intermediates for manufacturing APIs and other pharmaceuticals.

Formulations * Shilpa offers its products for different medical areas including Medicare Oncology Cardiology Neurology and Gastroenterology

Some of the products produced by Shilpa Medicare Limited are Capecitabine which is an oral chemotherapy drug for treating various types of cancer,

Anastrozole is an aromatase inhibitor used to treat breast cancer; Docetaxel is a chemotherapy drug used to treat various types of cancer.

Imatinib is a tyrosine kinase inhibitor used in the treatment of chronic myeloid leukemia and other cancers.

Tenofovir: An antiretroviral drug used to treat HIV and hepatitis B. These are popular drugs trusted by both doctors and patients.

Competiting Company Of Shilpa Medicare Ltd

Shilpa Medicare Limited has many domestic and international competing companies in the pharmaceutical industry, the major ones being Sun Pharmaceuticals Industries Limited and Cipla Limited.

Some of the major competitors of Shilpa Medicare Limited include:

Sun Pharmaceutical Industries Limited

Cipla Limited

Lupine Limited

Dr. Reddy’s Laboratories Limited

Aurobindo Pharma Limited

Torrent Pharmaceuticals Ltd

Biocon Limited

Cadila Healthcare Limited

Glenmark Pharmaceuticals Limited

Intas Pharmaceuticals Limited

Speciality Of Company In Its Sector

Shilpa Medicare has established itself as a leading player in the pharma sector, with particular focus on the cancer sector.

This company has focused more on research and development and has increased its capacity in API manufacturing and formulation. Some of its special features are as follows:-

Oncology – Shilpa Medicare Company is a big chain in the field of oncology. This company is expanding its products more and more in the field of cancer. Its portfolio is very large at the cancer level.

API Manufacturing – The API system of this company is very special and fast as compared to the common system, due to which this company is able to manufacture modern medicines, trees etc. well, due to which it is becoming international famous.

Contract Manufacturing – This company provides its services to other companies like it by taking contracts with them for making their medicines so that the goods, medicines etc. of those companies can work well and improve the health of the people.

Its purpose is that it should reach its international level of development and move forward in as many different fields as possible.

Shilpa Medicare Last 5 Year Financial Condition/Balance Sheet

| BALANCE SHEET OF SHILPA MEDICARE (in Rs. Cr.) | MAR 22 | MAR 21 | MAR 20 | MAR 19 | MAR 18 | |

| 12 mths | 12 mths | 12 mths | 12 mths | 12 mths | ||

| EQUITIES AND LIABILITIES SHAREHOLDER’S FUNDS | ||||||

| Equity Share Capital | 8.68 | 8.15 | 8.15 | 8.15 | 8.15 | |

| TOTAL SHARE CAPITAL | 8.68 | 8.15 | 8.15 | 8.15 | 8.15 | |

| Reserves and Surplus | 2,056.99 | 1,629.68 | 1,445.27 | 1,273.39 | 1,148.83 | |

| TOTAL RESERVES AND SURPLUS | 2,056.99 | 1,629.68 | 1,445.27 | 1,273.39 | 1,148.83 | |

| TOTAL SHAREHOLDERS FUNDS | 2,065.67 | 1,637.83 | 1,453.42 | 1,281.55 | 1,156.98 | |

| NON-CURRENT LIABILITIES | ||||||

| Long Term Borrowings | 120.28 | 324.52 | 164.48 | 81.10 | 68.11 | |

| Deferred Tax Liabilities [Net] | 75.04 | 56.84 | 30.39 | 56.00 | 61.07 | |

| Other Long Term Liabilities | 9.00 | 10.46 | 4.40 | 14.70 | 4.82 | |

| Long Term Provisions | 5.83 | 13.76 | 8.72 | 5.36 | 5.08 | |

| TOTAL NON-CURRENT LIABILITIES | 210.15 | 405.58 | 208.00 | 157.15 | 139.08 | |

| CURRENT LIABILITIES | ||||||

| Short Term Borrowings | 73.75 | 328.91 | 156.40 | 78.72 | 92.95 | |

| Trade Payables | 23.90 | 56.91 | 76.63 | 71.37 | 98.86 | |

| Other Current Liabilities | 516.00 | 76.99 | 119.85 | 76.53 | 56.68 | |

| Short Term Provisions | 6.65 | 11.17 | 6.97 | 2.97 | 2.57 | |

| TOTAL CURRENT LIABILITIES | 620.30 | 473.98 | 359.86 | 229.59 | 251.05 | |

| TOTAL CAPITAL AND LIABILITIES | 2,896.12 | 2,517.39 | 2,021.28 | 1,668.29 | 1,547.12 | |

| ASSETS | ||||||

| NON-CURRENT ASSETS | ||||||

| Tangible Assets | 548.30 | 624.29 | 500.39 | 460.49 | 437.81 | |

| Intangible Assets | 17.48 | 16.61 | 16.61 | 50.35 | 50.88 | |

| Capital Work-In-Progress | 52.57 | 297.19 | 244.18 | 284.80 | 131.00 | |

| Other Assets | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| FIXED ASSETS | 858.89 | 1,123.24 | 889.81 | 912.05 | 689.68 | |

| Non-Current Investments | 237.50 | 219.32 | 93.48 | 89.04 | 111.35 | |

| Deferred Tax Assets [Net] | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Long Term Loans And Advances | 577.97 | 357.94 | 96.18 | 72.11 | 33.75 | |

| Other Non-Current Assets | 17.85 | 37.00 | 34.12 | 74.67 | 59.12 | |

| TOTAL NON-CURRENT ASSETS | 1,692.22 | 1,737.50 | 1,113.59 | 1,147.87 | 893.90 | |

| CURRENT ASSETS | ||||||

| Current Investments | 0.00 | 0.00 | 0.00 | 0.00 | 119.54 | |

| Inventories | 101.77 | 299.08 | 206.23 | 176.70 | 167.72 | |

| Trade Receivables | 102.73 | 218.27 | 226.54 | 181.68 | 218.14 | |

| Cash And Cash Equivalents | 15.83 | 115.27 | 28.19 | 90.93 | 73.14 | |

| Short Term Loans And Advances | 0.01 | 0.01 | 0.01 | 3.90 | 7.00 | |

| OtherCurrentAssets | 983.56 | 147.27 | 446.72 | 67.20 | 67.68 | |

| TOTAL CURRENT ASSETS | 1,203.90 | 779.90 | 907.69 | 520.42 | 653.22 | |

| TOTAL ASSETS | 2,896.12 | 2,517.39 | 2,021.28 | 1,668.29 | 1,547.12 | |

| OTHER ADDITIONAL INFORMATION | ||||||

| CONTINGENT LIABILITIES, COMMITMENTS | ||||||

| Contingent Liabilities | 374.38 | 207.79 | 40.60 | 164.64 | 171.64 | |

| CIF VALUE OF IMPORTS | ||||||

| Raw Materials | 217.59 | 223.09 | 189.96 | 163.32 | 248.57 | |

| Stores, Spares And Loose Tools | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Trade/Other Goods | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Capital Goods | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| EXPENDITURE IN FOREIGN EXCHANGE | ||||||

| Expenditure In Foreign Currency | 63.82 | 109.08 | 23.82 | 13.46 | 16.70 | |

| REMITTANCES IN FOREIGN CURRENCIES FOR DIVIDENDS | ||||||

| Dividend Remittance In Foreign Currency | 1.21 | — | 1.26 | — | 0.42 | |

| EARNINGS IN FOREIGN EXCHANGE | ||||||

| FOB Value Of Goods | 651.36 | 507.79 | 520.64 | 398.69 | 422.60 | |

| Other Earnings | — | — | — | — | — | |

| BONUS DETAILS | ||||||

| Bonus Equity Share Capital | 3.78 | 3.78 | 3.78 | 3.78 | 3.78 | |

| NON-CURRENT INVESTMENTS | ||||||

| Non-Current Investments Quoted Market Value | — | — | — | — | — | |

| Non-Current Investments Unquoted Book Value | 237.50 | 219.32 | 93.48 | 89.04 | 111.35 | |

| CURRENT INVESTMENTS | ||||||

| Current Investments Quoted Market Value | — | — | — | — | — | |

| Current Investments Unquoted Book Value | — | — | — | — | 119.54 |

Source – MONEY CONTROL

Shilpa Medicare Annual Reports :-

Source – Valueresearchonline (You Can Also See Live Chart)

Shilpa Medicare Today’s Live chart :- Click Chart For Live

Shilpa Company Business Analysis

Shilpa Medicare Company Strength:-

1. Financial Strength:-

Here are some key financial strength indicators:-

debt-to-equity ratio

interest coverage ratio

current ratio

cash and cash equivalents

2. There Strength :-

Shilpa Medicare Limited has several strengths that have contributed to its success in the pharmaceutical industry. Here are some of the company’s key strengths:

Strong Product Portfolio:-

R&D Capabilities:

Manufacturing Capabilities:

Strong Distribution Network:

Experienced Management Team:

Shilpa Medicare Limited’s strengths have enabled it to build a reputation as a quality-driven and innovative pharmaceutical company that is well positioned to capitalize on growth opportunities in the domestic and international markets.

Cash Flow Statement analysis –

| Indicator | Graph | CAGR 3 Yrs | CAGR 5 Yrs | Mar-2022 | Mar-2021 | Mar-2020 | Mar-2019 | Mar-2018 | Mar-2017 | Mar-2016 | Mar-2015 | Mar-2014 | Mar-2013 | Mar-2012 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash from Operating Activity Annual Cr | -10.5% | 22.9% | 105.1 | 47.1 | 123.7 | 146.8 | 44.9 | 37.5 | 128.7 | 68.8 | 70.2 | 43.5 | 53.7 | |

| Cash from Investing Activity Annual Cr | 13.3% | 1.7% | -285.5 | -404.3 | -288.8 | -196.2 | -8.8 | -262.2 | -109.2 | -195.2 | -48.9 | -81.7 | -149.7 | |

| Cash from Financing Annual Activity Cr | 101.7% | -23.3% | 82.9 | 436.4 | 175.5 | 10.1 | -60.9 | 312.7 | -19.7 | 135 | -28.3 | 66.3 | 10.4 | |

| Net Cash Flow Annual Cr | 35.4% | – | -97.5 | 79.2 | 10.4 | -39.3 | -24.7 | 88 | -0.2 | 8.7 | -7.1 | 28.2 | -85.6 |

Source – Trendlyne

Shilpa Medicare Share Price Target 2023,2024,2025,2026,2027,2028,2029,2030,2040:-

We at Financesharetargets.in are here to give you estimated information about share price targets for 2022, 2023, 2024, 2025, 2026, 2027, 2028, 2029, 2030.

And 2040 Please note that this price target is only a suggestion given by our analysis. Price target which is made by us.

That would be accurate/correct is almost impossible. Errors are always present in any analysis, but we do our best to give you a good price target.

Shilpa Medicare Share Price Targets 2023

The company has a highly skilled and experienced work force, which always strives to meet the needs of the customers. Shilpa Medicare Company always strives for the highest standards in manufacturing,

Manufactures its products by adopting latest technology and providing best quality products. According to our analysis Fiam Industries share price target for 2023 is ₹250 first target and ₹260 second target.

| Date Opening price Closing price Minimum price Maximum price | |||||

May 2023 | 264.901 | 261.112 | 253.382 | 264.901 | |

| June 2023 | 260.501 | 256.038 | 254.457 | 261.493 | |

July 2023 | 259.733 | 281.916 | 259.355 | 281.916 | |

| August 2023 | 282.634 | 267.295 | 267.295 | 285.191 | |

September 2023 | 265.472 | 261.458 | 261.458 | 268.213 | |

| October 2023 | 262.872 | 259.925 | 259.851 | 264.119 | |

November 2023 | 259.139 | 252.353 | 248.235 | 259.139 | |

| December 2023 | 251.073 | 255.683 | 251.073 | 257.838 | |

Shilpa Medicare Share Price Target 2024

The company, through its research and development team, provides products that meet the needs of customers and are preferred by more and more people.

The company’s products are created by understanding the needs of the consumers through innovative technology, which enables the company to share the price target for the industries for 2024, the first target can be ₹240, the second target can be ₹255.

| Date Opening price Closing price Minimum price Maximum price | |||||

| January 2024 | 258.086 | 249.612 | 247.975 | 258.086 | |

| February 2024 | 248.621 | 233.640 | 233.640 | 248.621 | |

| March 2024 | 231.697 | 228.918 | 225.673 | 232.976 | |

| April 2024 | 234.761 | 263.729 | 234.761 | 266.649 | |

| May 2024 | 262.828 | 257.603 | 251.702 | 262.828 | |

| June 2024 | 260.260 | 254.259 | 253.114 | 260.260 | |

| July 2024 | 257.837 | 281.086 | 257.347 | 281.086 | |

| August 2024 | 280.969 | 264.534 | 264.534 | 283.789 | |

| September 2024 | 266.226 | 261.909 | 260.639 | 266.872 | |

| October 2024 | 261.557 | 257.174 | 257.174 | 262.903 | |

| November 2024 | 254.880 | 249.439 | 247.000 | 254.922 | |

| December 2024 | 252.534 | 256.719 | 250.780 | 256.807 | |

Shilpa Medicare Share Price Target 2025

With the changing world, the company is trying to produce its products as per the needs of the customers, which is its best feature. If we look at the share price targets 2025, the first target can be ₹245, the second target can be ₹256. |

| Date Opening price Closing price Minimum price Maximum price | |||||

| January 2025 | 256.606 | 245.813 | 245.813 | 256.606 | |

| February 2025 | 247.585 | 230.899 | 230.899 | 247.585 | |

| March 2025 | 232.097 | 231.848 | 224.334 | 232.097 | |

| April 2025 | 233.045 | 262.573 | 233.045 | 265.226 | |

| May 2025 | 260.895 | 255.970 | 250.168 | 260.895 | |

| June 2025 | 258.911 | 255.985 | 251.862 | 258.911 | |

| July 2025 | 256.346 | 278.740 | 255.372 | 278.758 | |

| August 2025 | 277.949 | 263.738 | 263.738 | 282.397 | |

| September 2025 | 265.104 | 260.609 | 259.852 | 265.645 | |

| October 2025 | 260.265 | 254.513 | 254.513 | 261.659 | |

| November 2025 | 254.576 | 247.783 | 245.876 | 254.576 | |

| December 2025 | 250.938 | 255.370 | 249.263 | 255.460 | |

Shilpa Medicare Share Price Target 2026

Due to the company’s API & formulation, its growth is increasing rapidly in the country and abroad. If we look at the share price targets of 2026, the first target can be ₹ 245, the second target can be ₹ 258.

| Date Opening price Closing price Minimum price Maximum price | |||||

| January 2026 | 254.474 | 244.681 | 244.681 | 258.623 | |

| February 2026 | 246.556 | 230.145 | 230.145 | 246.556 | |

| March 2026 | 231.247 | 230.175 | 223.117 | 231.247 | |

| April 2026 | 231.358 | 260.618 | 231.358 | 263.512 | |

| May 2026 | 258.264 | 254.228 | 248.796 | 258.264 | |

| June 2026 | 257.443 | 254.504 | 250.699 | 257.522 | |

| July 2026 | 254.878 | 275.694 | 253.430 | 276.389 | |

| August 2026 | 280.087 | 264.112 | 263.086 | 280.807 | |

| September 2026 | 263.778 | 259.332 | 259.076 | 264.337 | |

| October 2026 | 258.183 | 254.099 | 254.099 | 260.308 | |

| November 2026 | 254.237 | 249.315 | 244.430 | 254.237 | |

| December 2026 | 249.500 | 253.224 | 247.726 | 254.066 | |

Shilpa Medicare Share Price Target 2027

We cannot write the appropriate target for the company’s share but can write it approximately, the first target can be ₹ 243, the second target can be ₹ 254.

| Date Opening price Closing price Minimum price Maximum price | |||||

| January 2027 | 251.645 | 243.525 | 243.525 | 254.602 | |

| February 2027 | 245.476 | 229.440 | 229.440 | 245.476 | |

| March 2027 | 230.433 | 228.531 | 221.998 | 230.433 | |

| April 2027 | 228.885 | 257.963 | 228.682 | 262.540 | |

| May 2027 | 257.745 | 255.856 | 247.601 | 257.745 | |

| June 2027 | 256.019 | 253.045 | 249.324 | 256.126 | |

| July 2027 | 252.617 | 273.321 | 251.525 | 273.939 | |

| August 2027 | 278.033 | 262.813 | 262.575 | 279.723 | |

| September 2027 | 262.478 | 257.264 | 257.264 | 262.957 | |

| October 2027 | 255.408 | 253.617 | 253.617 | 258.918 | |

| November 2027 | 253.883 | 247.871 | 242.952 | 253.883 | |

| December 2027 | 248.080 | 250.381 | 246.163 | 252.690 | |

Shilpa Medicare Share Price Target 2028

Most of the company’s pressures are being made on cancer only. This company has put all its efforts to take its research development to sky heights so that this company can expand its market and get profit. Keeping this in view, our first Target ₹248, second target can be ₹252.

| Date Opening price Closing price Minimum price Maximum price | |||||

| January 2028 | 251.645 | 243.525 | 248.525 | 252.602 | |

| February 2028 | 242.476 | 229.440 | 248.440 | 252.476 | |

| March 2028 | 232.433 | 228.531 | 241.998 | 240.433 | |

| April 2028 | 227.885 | 257.963 | 238.682 | 252.540 | |

| May 2028 | 258.745 | 255.856 | 247.601 | 257.745 | |

| June 2028 | 255.019 | 253.045 | 248.324 | 246.126 | |

| July 2028 | 251.617 | 273.321 | 251.525 | 253.939 | |

| August 2028 | 277.033 | 262.813 | 242.575 | 259.723 | |

| September 2028 | 261.478 | 257.264 | 257.264 | 262.957 | |

| October 2028 | 252.408 | 253.617 | 254.617 | 258.918 | |

| November 2028 | 251.883 | 247.871 | 256.952 | 257.883 | |

| December 2028 | 250.080 | 250.381 | 248.163 | 256.690 | |

Shilpa Medicare Share Price Target 2029

Considering that the company is setting up its entire sector in India, our first target can be ₹255, second target can be ₹260.

| Date Opening price Closing price Minimum price Maximum price | |||||

| January 2028 | 255.645 | 243.525 | 255.525 | 260.602 | |

| February 2028 | 255.476 | 229.440 | 229.440 | 245.476 | |

| March 2028 | 242.433 | 228.531 | 221.998 | 230.433 | |

| April 2028 | 252.885 | 257.963 | 228.682 | 262.540 | |

| May 2028 | 251.745 | 255.856 | 247.601 | 257.745 | |

| June 2028 | 257.019 | 253.045 | 249.324 | 256.126 | |

| July 2028 | 252.617 | 273.321 | 251.525 | 273.939 | |

| August 2028 | 258.033 | 262.813 | 262.575 | 279.723 | |

| September 2028 | 252.478 | 257.264 | 257.264 | 262.957 | |

| October 2028 | 245.408 | 253.617 | 253.617 | 258.918 | |

| November 2028 | 243.883 | 247.871 | 242.952 | 253.883 | |

| December 2028 | 258.080 | 250.381 | 246.163 | 252.690 | |

Shilpa Medicare Share Price Target 2030

Competing companies of Shilpa Medicare Company are also given API & formulation by this company to make new medicines so that they can also make similar medicines. Our first target can be ₹ 262, second target can be ₹ 265.

| Date Opening price Closing price Minimum price Maximum price | |||||

| January 2028 | 263.645 | 260.525 | 262.525 | 265.602 | |

| February 2028 | 262.476 | 229.440 | 229.440 | 245.476 | |

| March 2028 | 264.433 | 228.531 | 221.998 | 230.433 | |

| April 2028 | 260.885 | 257.963 | 228.682 | 262.540 | |

| May 2028 | 257.745 | 255.856 | 247.601 | 257.745 | |

| June 2028 | 246.019 | 253.045 | 249.324 | 256.126 | |

| July 2028 | 252.617 | 273.321 | 251.525 | 273.939 | |

| August 2028 | 278.033 | 262.813 | 262.575 | 279.723 | |

| September 2028 | 262.478 | 257.264 | 257.264 | 262.957 | |

| October 2028 | 255.408 | 253.617 | 253.617 | 258.918 | |

| November 2028 | 253.883 | 247.871 | 242.952 | 253.883 | |

| December 2028 | 248.080 | 250.381 | 246.163 | 252.690 | |

Shilpa Medicare Share Price Target 2040

The way the company is developing its larger network and production capacity of more products and trying to increase its sales in different regions of India.

Also, at the international level also, it is estimated that there will be good growth prospects for the company in the coming time. As per our analysis the share price target for 2040 is ₹268 with the first target and ₹272 as the second target.

| Date Opening price Closing price Minimum price Maximum price | |||||

| January 2028 | 261.645 | 263.525 | 268.525 | 272.602 | |

| February 2028 | 265.476 | 269.440 | 264.440 | 265.476 | |

| March 2028 | 260.433 | 268.531 | 261.998 | 263.433 | |

| April 2028 | 268.885 | 267.963 | 268.682 | 262.540 | |

| May 2028 | 267.745 | 265.856 | 267.601 | 263.745 | |

| June 2028 | 266.019 | 263.045 | 259.324 | 264.126 | |

| July 2028 | 262.617 | 263.321 | 261.525 | 268.939 | |

| August 2028 | 268.033 | 262.813 | 262.575 | 270.723 | |

| September 2028 | 262.478 | 267.264 | 267.264 | 269.957 | |

| October 2028 | 265.408 | 263.617 | 263.617 | 268.918 | |

| November 2028 | 263.883 | 267.871 | 262.952 | 263.883 | |

| December 2040 | 268.080 | 260.381 | 266.163 | 252.690 | |

Shilpa Medicare Past Sales

The past sales figures of Shilpa Medicare Limited are as follows:

FY 2020-2021: INR 1,367 crore

FY 2019-2020: INR 1,144 crore

FY 2018-2019: INR 1,004 crore

Financial Year 2017-2018: INR 825 Crore

FY 2016-2017: INR 702 crore

Shilpa Medicare Ltd. Future Retail Competitor

Shilpa Medicare Limited is a pharmaceutical company, and as such, is not a direct competitor of Future Retail Limited, which is a retail company.

However, in the broader sense of competition in the Indian stock market, both companies compete for investors’ attention and capital.

Additionally, investors can compare the financial performance and valuation metrics of both companies to determine which offers a better investment opportunity.

Share Holding Pattern

| Share Holding Pattern | ||

| Holder’s Name | No of Shares | % Share Holding |

| NoOfShares | 86801898 | 100% |

| Promoters | 43409715 | 50.01% |

| ForeignInstitutions | 13310601 | 15.33% |

| NBanksMutualFunds | 42913 | 0.05% |

| Others | 10580505 | 12.19% |

| GeneralPublic | 18968401 | 21.85% |

| FinancialInstitutions | 489763 | 0.56% |

Note that this information is as per the company’s latest disclosures and is subject to change in the future.

10 Year’s Data of Shilpa Medicare Ltd.

Analysis of Financial Track Record

Data adjusted to bonus, split, extra-ordinary income, rights issue and change in financial year end

| Sales ⓘ | 371 | 571 | 614 | 716 | 779 | 789 | 733 | 908 | 901 | 1,146 | 1,127 |

| YoY Gr. Rt. % | – | 53.9% | 7.4% | 16.7% | 8.8% | 1.2% | -7% | 23.8% | -0.8% | 27.1% | – |

| Adj EPS ⓘ | 6.4 | 11.1 | 9.4 | 14.4 | 13 | 12 | 10.7 | 17.7 | 10.9 | 5.9 | 0.6 |

| YoY Gr. Rt. % | – | 75% | -15.8% | 53.8% | -10.1% | -7.6% | -10.6% | 65.6% | -38.4% | -46.3% | – |

| BVPS (₹) ⓘ | 43.5 | 53.9 | 70.9 | 82.9 | 123.2 | 133.1 | 146.9 | 163.1 | 181.4 | 209.9 | 206.2 |

| Adj Net Profit ⓘ | 46.8 | 81.9 | 72.2 | 111 | 104 | 97.7 | 87.3 | 145 | 89 | 51 | 5 |

| Cash Flow from Ops. ⓘ | 43.6 | 70 | 68.8 | 129 | 37.5 | 44.9 | 147 | 124 | 46.9 | 105 | – |

| Debt/CF from Ops. ⓘ | 3 | 1.7 | 2.7 | 0.7 | 6.4 | 4.3 | 1.3 | 3.1 | 18 | 6.5 | – |

Source –moneyworks4me.com

| CAGR ⓘCAGR Colour Code Guide ⓘ | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 9 Years | 5 Years | 3 Years | 1 Years | |||||||||

| Sales ⓘ | 13.3% | 8% | 16% | 27.1% | ||||||||

| Adj EPS ⓘ | -0.9% | -14.7% | -18.2% | -46.3% | ||||||||

| BVPS ⓘ | 19.1 | 11.3 | 12.6 | 15.8 | ||||||||

| Share Price | 10.4% | -13.2% | -3.7% | -44.6% | ||||||||

Source –moneyworks4me.com

| Key Financial Parameters ⓘPerformance Ratio Colour Code Guide ⓘ | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mar’13 | Mar’14 | Mar’15 | Mar’16 | Mar’17 | Mar’18 | Mar’19 | Mar’20 | Mar’21 | Mar’22 | TTM | ||

| Return on Equity % ⓘ | 15.7 | 22.8 | 15.3 | 18.7 | 12.8 | 9.4 | 7.7 | 11.4 | 6.3 | 3.1 | 0.3 | |

| On. Profit Mgn % ⓘ | 18.5 | 21.3 | 20.6 | 22.5 | 20.8 | 19.2 | 21.1 | 23.6 | 19.1 | 17.4 | 12.2 | |

| Net Profit Mgn % ⓘ | 12.6 | 14.2 | 11.6 | 15 | 12.9 | 12.1 | 11.5 | 15.8 | 9.7 | 4.4 | 0.5 | |

| Debt to Equity ⓘ | 0.4 | 0.3 | 0.3 | 0.1 | 0.2 | 0.2 | 0.2 | 0.3 | 0.6 | 0.4 | – | |

| Working Cap Days ⓘ | 151 | 135 | 158 | 158 | 193 | 237 | 266 | 230 | 277 | 273 | 0 | |

| Cash Conv. Cycle ⓘ | 44 | 40 | 56 | 59 | 84 | 116 | 141 | 126 | 166 | 161 | 0 | |

Source –moneyworks4me.com

Recent Performance Summary

Sales growth has been growing at a good rate over the last 3 years at 16.03%

Sales growth is good at 14.80% over the last 4 quarters

Return on equity has fallen to 0.30% compared to the last 3 year average

Net profit has decreased in the last 3 years by -18.16%

Latest Financials – Shilpa Medicare Ltd.

| Standalone | Consolidated | |

|---|---|---|

| TTM EPS (₹) | -2.7 | 0.6 |

| TTM Sales (₹ Cr.) | 254 | 1,127 |

| BVPS (₹.) ⓘ | 247 | 206.2 |

| Reserves (₹ Cr.) ⓘ | 2,135 | 1,781 |

| P/BV ⓘ | 0.93 | 1.11 |

| PE ⓘ | 0.00 | 388.28 |

Source –moneyworks4me.com

| From the Market | |

|---|---|

| 52 Week Low / High (₹) | 222.40 / 503.05 |

| All Time Low / High (₹) | 0.39 / 786.75 |

| Market Cap (₹ Cr.) | 1,991 |

| Equity (₹ Cr.) | 8.7 |

| Face Value (₹) | 1 |

| Industry PE ⓘ | 36.2 |

Source –moneyworks4me.com

Quarterly Results

| Mar’22 | Gr. Rt. % | Jun’22 | Gr. Rt. % | Sep’22 | Gr. Rt. % | Dec’22 | Gr. Rt. % | |

|---|---|---|---|---|---|---|---|---|

| Sales ⓘ | 341 | 63.7 | 261 | 10 | 263 | -11 | 263 | -3.6 |

| Adj EPS ⓘ | 3.4 | 255.2 | 0.1 | -47.4 | -2.2 | -228 | -0.8 | -169.1 |

| On. Profit Mgn % ⓘ | 21.65 | – | 7.88 | – | 4.64 | – | 11.92 | – |

| Net Profit Mgn % ⓘ | 9.00 | – | 1.18 | – | -6.23 | – | -2.65 | – |

Source –moneyworks4me.com

Company Major Risk & Economic Weakness:-

Here we will tell you some economic and major risk weaknesses of this company:-

1. Regulatory Risk – This industry is highly regulated and the company may face some challenges in getting its products approved.

They may face some delay in approval of their product or their financial performance may be affected.

2. Competition:- This company has to face other good players in the pharmaceutical industry, this divides the market and customer share of this company in the market.

3. Dependence on Key Customers – The company derives some of its annual revenue from some of its own key customers and if a customer leaves this company and goes to another company, its financial performance may be affected.

4. Dependence on Key Products:- If any product of the company is less useful or in demand in the market, then the company may have to face competition on its product.

5. Foreign Exchange Risk:- As a company that exports its products, it may face problems due to fluctuations in currency rates.

6. Economic Condition:- In the pharmaceutical industry, it can be affected if the demand for products increases and the company’s economy is not good.

Let us tell you that the company has its own strategies by which they manage themselves, due to this you will have to do market research beforehand and only then you will have to decide to invest in it.

Compound Sales Growth & Profit :-

According to the available financial data, the CAGR of this company was around 11 point 5 percent.

This data is from the financial year 2016 to 2001, this data has reduced in 2022,

Due to this, you should note that there are ups and downs in it. Due to the arrival of Covid-19, a boom was seen in the company but it decreased in 2022.

Company Stock Pe Ratio & Book Value :-

Due to being dependent on the current market, we do not yet have the Pay Ratio and Book Value for March 31, 2023. If it becomes available, we will update it and let you know. It is important for you to see this.

That by looking at the past record of the company, you cannot say that it will be like this, at any time it can bounce further and go further up or down further.

We again recommend that you invest using your own judgment.

Shilpa Medicare Company Latest Infra Share News Study :-

You can easily find the latest infrastructure stock news by searching online news websites or financial news outlets.

Some popular choices include Reuters, Bloomberg, CNBC, and Economic Times.

You may also consider setting up alerts or notifications for news related to Shilpa Medicare Limited or the infrastructure industry,

So that you can stay updated on the latest happenings.

About Investing In Company –

Before investing in the shares of Shilpa Medicare or any other company, you should have a method of the company,

Investigating and analyzing industry trends requires thorough research and thinking for any investment.

We tell you some points which you can read to ensure your investment:-

1. To evaluate the company’s financial performance, growth potential and industry trends.

2. Assessing the company’s management teams and its track record.

3. Evaluating the competitive position of the company, its financial strengths, weaknesses and looking into the future.

4. Seeing the company’s valuation and financial metrics falling short of the company’s value.

5. If you want to reduce the risk of investment, then you can also go to different companies and by looking at them you can ensure investment.

Current Status Of Company :-

Let us tell you the current status that the growth of this company has gone down which is worrying, you can see this through the live chart provided by us.

Link – LIVE CHART

How To Buy Share :-

To buy shares of Shilpa Medicare Limited or any other company you need to follow these steps:

Open a Demat Account: A demat account is a type of account where your purchased shares are stored electronically. You can open a Demat account with a bank, financial institution or brokerage firm.

Fund your account: After opening a demat account, you need to deposit money into it to buy shares. You can transfer money to your demat account through net banking or by visiting your bank branch.

Choose a Broker: To buy shares, you need to choose a broker who can execute your trades. You can select a broker based on their reputation, commission fees and other services they provide.

Placing Orders: After choosing a broker, you can place orders to buy shares of Shilpa Medicare Limited through their online trading platform or by calling their customer care.

Keep an eye on your investments: After buying shares, it is important to monitor your investments regularly to stay updated with the company’s performance and market trends.

Expert Opinion On Shilpa Medicare :-

Future Of Shilpa Medicare Ltd:-

Let us tell you that this company is going ahead in the field of oncology. This company has an important area in the Indian pharma industry.

This company provides medicines for dangerous diseases in the market through new technologies so that the best future can be created for the Indian and foreign companies. This company is engaged in correcting its mistakes.

Its API and formulation systems have become more state-of-the-art, however, due to the increasing incidence of cancer and other diseases, the demand for oncology and critical care medicines is increasing.

From which it can be expected that there will be demand for it in the coming days also, which is a good sign, this sign will take the company even further.

Risk In Shilpa Medicare Ltd.

The pharmaceutical industry is highly regulated and any change in regulation can affect a company’s operations. The pharmaceutical industry is very competitive.

And there are many companies in the market which are making medicines in competition with it and if any company increases its selling price, quality etc. then this company can lag behind them.

Our suggestion:-

Shilpa Medicare Company Limited is trying to promote all its products domestically and internationally.

Due to which the expansion of this company can be estimated in the near future due to which its shares can be expected to increase. In such a situation, if you are an experienced investor.

So you can decide for yourself whether you should invest in this company or not and if you are an investor.

So you must take information related to investment from the company and you can also visit the company’s website to get its basic information and also you must take advice from your financial advisor.

Conclusion:-

In the end we want to tell you that Shilpa Medicare is an Indian company which has established its foothold in the pharmaceutical industry.

This company ensures research and development of generic active pharmaceutical ingredients and formulations. This company has tried to bring good performance in its revenue growth in the last few financial years.

A good effort has been made by this company to spread its expansion in the country and abroad. This company delivers the medicines manufactured by it to the hospitals, which ensures the treatment of patients suffering from cancer.

Like every company, this is also a company which has its own risks and its own challenges. You should decide to invest only after seeing these and thinking for yourself so that you can get the best profit.

This company takes decisions keeping in mind both good diligence and caution for its customers.

Is company a good stock to buy ?

I can provide information about the company’s financials, operations and other relevant factors that can help investors make informed decisions.

Ultimately, it is important to do your own research, assess your risk tolerance and investment goals, and consult a financial advisor before making any investment decisions.

FAQ :-

Shilpa Medicare Company FAQs:-

What is the business model of Shilpa Medicare Company?

A: Shilpa Medicare Company is a pharmaceutical company that specializes in manufacturing and marketing active pharmaceutical ingredients (APIs), formulations and biotech products for the global market.

When was Shilpa Medicare Company established?

A: Shilpa Medicare Company was established in 1987.

What is the revenue of Shilpa Medicare Company?

A: Shilpa Medicare Company’s revenue is ₹1,982 crore.

What is the net profit of Shilpa Medicare Company?

A: Net profit of Shilpa Medicare Company was Rs 193.718 crore .

Who are the major customers of Shilpa Medicare Company?

A: Some of the major customers of Shilpa Medicare Company include Teva, Pfizer, AstraZeneca and Mylan.

Where is the headquarters of Shilpa Medicare Company?

A: Shilpa Medicare Company is headquartered in Hyderabad, India.

What are some of the products offered by Shilpa Medicare Company?

A: Shilpa Medicare Company offers products such as APIs, formulations and biotech products including oncology products, nutraceuticals and veterinary products.

What is the stock symbol of Shilpa Medicare Company?

A: Shilpa Medicare Company’s stock symbol is SHILPAMED on the National Stock Exchange of India (NSE) and SHILPAMED-BE on the Bombay Stock Exchange of India (BSE).

What is the market capitalization of Shilpa Medicare Company?

A: As of March 31, 2023, the market capitalization of Shilpa Medicare Company is INR 6,344.81 crore.

Does Shilpa Medicare Company pay dividends to its shareholders?

A: Yes, Shilpa Medicare Company pays dividends to its shareholders. For the financial year 2020-2021, the company paid a dividend of INR 3 per share.

Note –

The stock forecast/price forecast/target given on our website is only for information and educational purpose for stock market participants/traders/investors.

The content we provide here should not be construed as any financial advice or any other type of advice to invest or trade. One should do their own research and analysis before acting on these comments for any stock as the information is only tentative.

Trading and investing involves high risk, please consult your financial advisor before taking any decision and no responsibility will be taken by Financesharetargets.in for any consequences that may arise from acting on these comments.