FCS Software overview

FCS Software Solutions Limited develops and maintains computer software. Its headquarter is located in Noida, India.

Along with this, it is a leading global provider of IT services and solutions. The company was founded in 1993 by Mr. Ramesh Chandra and has consistently been a trusted name in the industry since its inception, providing a wide range of software solutions and services to customers across the globe.

FCS Software Solutions also pays special attention to innovation and continuously strives to deliver high quality solutions that help customers achieve their business objectives.

The company has a diverse portfolio of services that includes application development and maintenance, software testing, infrastructure management and business process outsourcing.

With over 25 years of experience in the industry, FCS has built a reputation for its deep domain expertise, technical excellence and strong customer base.

The company has an efficient and strong work force of over 1500 professionals who work together to understand the varying business needs of the clients and deliver tailor-made services to meet their needs.

FCS Software Solutions has a global presence with offices in the United States, Europe and Asia.

The company’s application development and maintenance services include complete software development work from concept and design to maintenance.

FCS specializes in a variety of technologies and platforms including Microsoft .NET, Java, Oracle, SAP, and mobile app development. The company’s software testing services include functional testing, performance testing, and security testing, among others.

FCS also provides infrastructure management services that help customers manage their IT infrastructure more efficiently and cost effectively. These services include Server and Network Management, Database Management and Cloud Migration and Management.

Along with its core IT services, FCS Software Solutions also provides Business Process Outsourcing (BPO) services that help clients optimize their operations and reduce costs.

FCS Software Solutions has received numerous awards and recognitions for its excellence in the industry. The company has been recognized as one of the Top 50 IT Companies in India by Dataquest and has also been included in the Deloitte Technology Fast 500 list. In this way the company is moving forward with strength and respect in its industry.

Thus, FCS Software Solutions is a global leader in IT services and solutions with a strong focus on innovation and customer satisfaction.

The company’s distinctive features set it apart. With its commitment to quality and customer focus, FCS has been steadily growing in the software solutions industry.

Read Also – Metro Brands Share Price Target 2023,2024,2025,2028,2030,2040|Earn

FCS Software Business Model

FCS Software Solutions Limited works on the business model of providing high quality IT Services & Solutions to customers around the world.

The company’s business model has been designed keeping in mind profitability and sustainability along with providing convenience as per customer requirement.

One of the key features of FCS Software Solutions’ business model is its strong focus on customer satisfaction. The company believes in building a strong and long term relationship with the customers by serving them as per their demands and providing solutions that meet or exceed their expectations.

FCS believes in working closely with clients to understand their business needs, challenges and goals and provide customized solutions that significantly assist them in achieving their objectives.

The business model of the company is also based on Innovation and Technological Excellence. FCS Software Solutions also invests significantly in Research and Development to stay ahead of the growing technology and trends with time.

This enables the company to provide cutting-edge solutions that are at the forefront of the industry. FCS also has a very efficient and strong management team who have expertise in various technologies and platforms, which helps the company to provide the customers with the service they require.

FCS Software Solutions’ business model also includes a diverse portfolio of offerings. The company provides a wide range of IT services and solutions covering various domains and industries.

The company’s business model also focuses on reasonable costs and efficiency. FCS Software Solutions uses a variety of models to optimize costs while striving to deliver high quality services to its customers. The company also uses automation and process optimization techniques to improve efficiency and reduce delivery times.

Another key feature of FCS Software Solutions’ business model is its global presence. The company has offices in the United States, Europe and Asia, which helps it serve customers across different time zones and geographies. This global presence also enables the company to tap into different markets and expand its reach.

FCS Software Solutions’ business model also has a strong focus on talent management. The company has a highly skilled workforce of more than 1500 professionals, who are selected for their experience and expertise.

Along with all this, the company also pays full attention to environmental protection and social responsibility.

Overall, it can be said that the business model of FCS Software Solutions is focused on providing high quality IT services and solutions to its customers. Meet the needs of our customers while ensuring profitability and sustainability.

The company’s focus on customer satisfaction, innovation, diverse portfolio, cost optimization, global presence, experienced management and corporate social responsibility have helped it earn a trusted name in the industry. And the company is continuously moving towards its development through these characteristics.

FCS Software Solutions Limited is a global IT Services & Solutions provider.

Basics Of FCS Software

Company Name- FCS Software Solutions Limited

Year of Establishment- 1993

Headquarters- Noida, Uttar Pradesh (India)

कंपनी की सेवाओं में IT Infra Services, Application Services, Artificial Intelligence, Workspace Solutions, Learning Solutions

,Business Process Services,Testing Services,Talent Services,Outsourcing to Captive,Startup Services शामिल है

FCS Software Solutions is staffed by around 1500+ professionals with expertise in various technologies and platforms including Microsoft .NET, Java, Oracle, SAP and mobile app development.

The company continues to grow with a strong focus on innovation and technological excellence, investing heavily in research and development to meet customer needs.

Talking about the company’s features, it has more than 25 years of experience in technology and about 1500 more experienced and strong workforce in the vertical. Global development center and customer strength. 100% company-owned infrastructure. All these features make the company strong. taking forward with

The company’s diverse portfolio of offerings includes application development and maintenance, software testing, infrastructure management and business process outsourcing.

FCS offers a wide range of IT services and solutions to its customers across various industries such as Healthcare, Banking & Finance, Retail & Manufacturing.

In addition to its core IT services, FCS Software Solutions also provides Business Process Outsourcing (BPO) services that help clients streamline their operations and reduce costs. The company’s BPO services cover various functions like Finance & Accounting, Human Resources & Customer Support.

The best thing about the company is that it first pays attention to the needs of the customers and along with their needs, it also works to develop itself according to the times and along with all this, it also fulfills its responsibilities towards the environment and society. Remains alert for

FCS Software Solutions has a global presence with offices in the United States, Europe and Asia. The company serves customers across different time zones and geographies, providing tailored solutions to meet the unique needs of each customer.

Overall, FCS Software Solutions is a leading global IT services and solutions provider with an emphasis on innovation, technical excellence and customer satisfaction.

The company’s diverse portfolio of offerings, global presence and commitment to Corporate Social Responsibility make it a trusted name in the industry and this credibility is continuously helping the company move forward.

Performance Of FCS Software

FCS Software Solutions Limited has been consistently performing well globally in the IT services and solutions industry since its inception in 1993. The company also has a strong track record of delivering high quality services and solutions to customers across the globe.

Talking about financial performance, FCS Software Solutions has been growing steadily over the years. The company’s revenue has increased from approximately Rs 15.5 crore in 2002 to approximately Rs 319 crore in 2021,

Which represents a CAGR growth of approximately 22.70%. According to the information of DEC.22 in the financial year 2022, the company recorded an increase of Net profit margin of about 8.28 which indicates a good growth.

The company’s growth has been driven by its diversified portfolio of offerings, which continuously works to deliver its services across different industries and sectors.

FCS has a strong presence in healthcare, banking and finance, retail and manufacturing industries, among other sectors. The company also has a good presence at the global level.

Talking about awards and recognitions, the company has been honored with many awards and recognitions for its excellent work and services. The company has been recognized as one of the top 50 IT companies of India by Dataquest and among the Deloitte Technology Fast 500. Has also been included in the list.

One of the major reasons for this is that the company has an experienced and strong management team. The company has a strong focus on talent management and invests heavily in employee training and development to achieve this. FCS Software Solutions’ commitment to customer satisfaction has also been a key factor in its success.

All this gives us hope that FCS Software Solutions will continue to work towards continued growth and success in the years to come.

The company’s strong focus on innovation, technical excellence and customer satisfaction, along with its diverse portfolio of offerings and global presence, have continuously strived to make it a trusted name in the industry.

The performance of the company can thus be understood because of the way, FCS Software Solutions has emerged as a highly successful IT services and solutions provider with a strong track record of providing high quality services and solutions to customers across the globe. Famous among the people.

Fundamental Analysis Of FCS Software

Update soon

Share Holders & Holding Pattern Of FCS Software

| Shareholding Pattern – FCS Software Solutions Ltd. | ||

| Holder’s Name | No of Shares | % Share Holding |

| NoOfShares | 1709553100 | 100% |

| Promoters | 335962450 | 19.65% |

| ForeignInstitutions | 525528 | 0.03% |

| NBanksMutualFunds | 0 | 0% |

| Central Govt | 568300 | 0.03% |

| Others | 289841911 | 16.95% |

| GeneralPublic | 1082654911 | 63.33% |

Services Given By FCS Software

Update Soon

Share Price History Of FCS Software

Update Soon

Similar Stocks Of FCS Software

| Name | Last Price | Market Cap. (Rs. cr.) | Sales Turnover | Net Profit | Total Assets |

| TCS | 3,176.00 | 1,162,114.72 | 190,354.00 | 39,106.00 | 74,538.00 |

| Infosys | 1,224.90 | 508,157.12 | 124,014.00 | 23,268.00 | 67,745.00 |

| HCL Tech | 1,053.45 | 285,871.05 | 46,276.00 | 11,459.00 | 41,295.00 |

| Wipro | 375.65 | 206,158.49 | 59,574.40 | 12,135.30 | 62,029.80 |

| LTIMindtree | 4,186.40 | 123,845.28 | 24,845.40 | 3,912.30 | 8,402.90 |

| Tech Mahindra | 997.00 | 97,124.02 | 34,726.10 | 4,913.10 | 27,079.60 |

| Mindtree | 3,433.85 | 56,643.29 | 10,525.30 | 1,652.80 | 5,473.40 |

| Persistent | 4,472.20 | 34,178.79 | 5,117.55 | 791.13 | 3,319.45 |

| MphasiS | 1,759.80 | 33,154.64 | 7,389.55 | 1,235.25 | 4,799.67 |

| Oracle Fin Serv | 3,419.05 | 29,545.66 | 3,896.13 | 1,811.21 | 5,802.47 |

| COFORGE LTD. | 3,929.95 | 24,010.35 | 3,313.20 | 644.50 | 2,542.80 |

| KPIT Tech | 852.00 | 23,357.05 | 1,180.99 | 238.12 | 1,221.45 |

| Info Drive Soft | 332.80 | 21,805.33 | 21.67 | 0.22 | 169.14 |

| Hexaware Tech | 470.80 | 14,139.56 | 2,140.91 | 507.53 | 1,951.31 |

| Cyient | 1,157.60 | 12,800.16 | 2,227.90 | 354.80 | 2,839.20 |

| Affle India | 903.05 | 12,033.24 | 397.52 | 56.55 | 843.79 |

| Happiest Minds | 802.30 | 11,782.86 | 1,033.54 | 186.48 | 860.38 |

| Sonata | 836.95 | 11,735.08 | 758.14 | 235.19 | 571.75 |

| Route | 1,251.60 | 7,815.39 | 333.81 | 27.76 | 1,224.97 |

| Birlasoft | 265.25 | 7,290.94 | 2,049.38 | 296.05 | 1,588.93 |

| Latent View | 351.80 | 7,208.43 | 206.76 | 75.89 | 855.61 |

| Zensar Tech | 267.95 | 6,068.14 | 1,628.90 | 320.80 | 2,081.40 |

| Intellect Desig | 433.25 | 5,880.18 | 1,255.01 | 202.08 | 1,455.41 |

| Talc | 1,703.60 | 5,200.88 | 313.39 | 132.14 | 745.44 |

| Polaris Consult | 474.60 | 4,893.06 | 1,817.31 | 180.82 | 930.53 |

| R Systems Intl | 256.95 | 3,039.81 | 813.89 | 112.71 | 392.26 |

| Datamatics Glob | 298.20 | 1,757.87 | 578.51 | 111.12 | 712.03 |

| Infinite Comp | 473.75 | 1,580.22 | 423.44 | 72.67 | 625.52 |

| Expleo Solution | 1,278.65 | 1,310.93 | 404.51 | 49.83 | 208.97 |

| Sasken Tech | 833.05 | 1,253.81 | 385.89 | 128.30 | 656.57 |

| Axiscades Tech | 302.75 | 1,156.48 | 181.98 | 3.08 | 204.59 |

| RPSG VENTURES | 389.60 | 1,149.76 | 161.50 | 144.67 | 2,293.13 |

| Genesys Int | 295.40 | 1,115.29 | 119.63 | -84.38 | 207.76 |

| Spacenet Ent | 16.70 | 885.70 | 40.05 | 0.76 | 36.67 |

| Varanium | 757.25 | 761.14 | – | – | – |

| Onward Tech | 327.15 | 731.09 | 234.40 | 9.32 | 148.78 |

| Quick Heal Tech | 135.75 | 720.48 | 278.11 | 7.70 | 419.72 |

| Xchanging Sol | 57.35 | 638.90 | 43.85 | 22.19 | 267.33 |

| 3i Infotech | 32.70 | 550.88 | 212.04 | 8.42 | 931.40 |

| Kellton Tech | 52.25 | 504.37 | 123.18 | 10.89 | 177.91 |

| Dynacons Sys | 387.10 | 491.35 | 653.98 | 16.46 | 129.60 |

| Gold Proptech | 115.10 | 453.10 | 1.65 | -8.52 | 167.68 |

| Allied Digital | 79.55 | 436.23 | 122.58 | 5.69 | 535.43 |

| Kernex Micro | 261.45 | 404.19 | 5.36 | -16.58 | 70.54 |

| FCS Software | 2.10 | 359.01 | 34.32 | 0.08 | 321.12 |

| EQUIPPP | 33.65 | 346.92 | — | -2.95 | 7.27 |

| Cybertech | 118.25 | 336.69 | 79.22 | 9.57 | 119.20 |

| DUGLOBAL | 200.00 | 290.00 | 4.56 | 0.26 | 6.93 |

| Dwelling Tech | 91.55 | 281.84 | 94.26 | 1.02 | 190.63 |

| Vertoz Advertisement | 231.30 | 276.87 | 20.52 | 3.70 | 40.43 |

| E2E Networks | 176.00 | 254.76 | 51.87 | 6.45 | 39.40 |

| AIR PRESSURE | 54.40 | 233.62 | — | — | – |

| Dev Information | 101.05 | 223.51 | 99.03 | 1.92 | 43.26 |

| Sigma Solve | 215.00 | 220.97 | 10.78 | 1.22 | 11.00 |

| Inspirisys Only | 54.95 | 217.69 | 298.39 | 0.29 | 127.13 |

| Goldstone Tech | 61.85 | 213.89 | 54.91 | 0.97 | 58.60 |

| Megasoft | 28.80 | 212.46 | 14.11 | 5.58 | 209.51 |

| Pressman Advt | 86.70 | 203.60 | 14.08 | 4.51 | 44.94 |

| Visesh Infotech | 0.45 | 169.85 | 0.49 | -4.12 | 453.94 |

| IZMO | 125.20 | 167.66 | 29.79 | 0.10 | 171.05 |

| P E Analytics | 158.00 | 165.62 | 23.91 | 9.31 | 55.21 |

| Palred Tech | 132.10 | 161.59 | 1.50 | 4.01 | 37.92 |

| Bartronics | 4.25 | 129.45 | 65.56 | -50.30 | 274.51 |

| Securekloud Tec | 32.05 | 107.08 | 44.23 | -5.58 | 157.89 |

| Fidel Softech | 77.35 | 106.36 | 26.31 | 4.57 | – |

| Cambridge Tech | 50.85 | 99.82 | 46.48 | 2.06 | 56.73 |

| Globesecure | 108.00 | 98.37 | 26.37 | 1.00 | 18.12 |

| Fourth Dimension | 26.50 | 86.32 | 1.53 | 62.96 | 221.21 |

| Panache Digilif | 60.70 | 72.84 | 85.28 | 2.10 | 58.46 |

| AURUM RE | 13.35 | 57.33 | — | — | – |

| Tera Software | 36.45 | 45.61 | 127.14 | -1.30 | 167.93 |

| Adroit Infotech | 23.95 | 43.75 | 6.37 | 0.62 | 8.74 |

| Mindpool Techno | 75.95 | 32.18 | 22.03 | 0.46 | 12.40 |

| Rolta | 1.75 | 29.03 | 7.53 | -606.14 | 1,725.51 |

| Bodhtree Cons | 13.80 | 27.54 | 104.19 | 0.72 | 85.70 |

| Elnet Tech | 66.85 | 26.74 | 22.08 | 12.61 | 114.00 |

| Quadpro ITeS | 4.90 | 24.77 | 9.68 | 0.97 | 17.54 |

| Panoramic Uni | 1.65 | 12.83 | 34.75 | 3.44 | 345.42 |

| Megasoft RE | 4.10 | 12.10 | — | — | – |

| Usha Martin Edu | 3.85 | 10.17 | 0.78 | 0.05 | 16.24 |

| India Globe | 2.60 | 4.12 | 3.59 | -0.72 | 95.21 |

| Gemini Comm | 0.20 | 2.48 | 5.64 | -65.03 | 91.49 |

| Quintegra Cells | 0.90 | 2.41 | — | -0.06 | -0.07 |

| Zylog Systems | 0.35 | 2.06 | 101.66 | -19.30 | 21.20 |

| ICSA | 0.20 | 0.96 | — | -117.69 | -348.25 |

Source – Money Control

History Of FCS Software

Update Soon

Net Worth Of FCS Software

Market capitalization of FCS Software is ₹3.61 Billion.

Income Statement Analysis Of FCS Software

Valuation Of FCS Software(You Can Click On Chart For live)

Vision & Value Of FCS Software

Update soon

Products Of FCS Software

Update Soon

Competitor Comparision Of FCS Software

| Stock | FY PE Ratio | PB Ratio | Dividend Yield |

|---|---|---|---|

| FCS Software Solutions Ltd | -5,983.44 | 1.03 | — |

| Tata Elxsi Ltd | 70.85 | 24.32 | 0.68% |

| L&T Technology Services Ltd | 37.91 | 8.69 | 1.02% |

| Persistent Systems Ltd | 36.26 | 9.92 | 1.14% |

Source – Tickertape

Speciality Of FCS Software In Its Sector

Update soon

Revenue Distribution By Sectors Of FCS Software

Update soon

Balance Sheet Analysis Of FCS Software

| BALANCE SHEET OF FCS SOFTWARE SOLUTIONS (in Rs. Cr.) | MAR 22 | MAR 21 | NOV 20 | MAR 20 | MAR 19 | |

| 12 mths | 12 mths | 12 mths | 12 mths | 12 mths | ||

| EQUITIES AND LIABILITIES | ||||||

| SHAREHOLDER’S FUNDS | ||||||

| Equity Share Capital | 170.96 | 170.96 | 170.96 | 170.96 | 170.96 | |

| TOTAL SHARE CAPITAL | 170.96 | 170.96 | 170.96 | 170.96 | 170.96 | |

| Reserves and Surplus | 128.36 | 126.96 | 128.64 | 128.64 | 164.71 | |

| TOTAL RESERVES AND SURPLUS | 128.36 | 126.96 | 128.64 | 128.64 | 164.71 | |

| TOTAL SHAREHOLDERS FUNDS | 299.32 | 297.92 | 299.59 | 299.59 | 335.66 | |

| NON-CURRENT LIABILITIES | ||||||

| Long Term Borrowings | 18.73 | 21.85 | 26.99 | 24.13 | 27.32 | |

| Deferred Tax Liabilities [Net] | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Other Long Term Liabilities | 3.41 | 4.99 | 5.26 | 5.26 | 4.88 | |

| Long Term Provisions | 1.31 | 0.00 | 0.00 | 0.00 | 0.00 | |

| TOTAL NON-CURRENT LIABILITIES | 23.45 | 26.84 | 32.25 | 29.38 | 32.20 | |

| CURRENT LIABILITIES | ||||||

| Short Term Borrowings | 3.08 | 2.76 | 0.00 | 2.86 | 0.00 | |

| Trade Payables | 1.06 | 1.06 | 1.50 | 1.50 | 2.78 | |

| Other Current Liabilities | 3.35 | 5.73 | 3.68 | 3.68 | 8.06 | |

| Short Term Provisions | 0.20 | 0.05 | 0.04 | 0.04 | 0.03 | |

| TOTAL CURRENT LIABILITIES | 7.70 | 9.60 | 5.22 | 8.09 | 10.87 | |

| TOTAL CAPITAL AND LIABILITIES | 330.46 | 334.36 | 337.06 | 337.06 | 378.73 | |

| ASSETS | ||||||

| NON-CURRENT ASSETS | ||||||

| Tangible Assets | 184.81 | 189.27 | 195.58 | 195.58 | 196.16 | |

| Intangible Assets | 0.14 | 0.15 | 0.17 | 0.17 | 0.28 | |

| Capital Work-In-Progress | 2.55 | 1.64 | 0.64 | 0.64 | 5.47 | |

| Other Assets | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| FIXED ASSETS | 187.50 | 191.06 | 196.39 | 196.39 | 201.91 | |

| Non-Current Investments | 111.63 | 102.72 | 104.33 | 104.33 | 127.04 | |

| Deferred Tax Assets [Net] | 0.78 | 0.98 | 1.12 | 1.12 | 1.13 | |

| Long Term Loans And Advances | 18.51 | 16.68 | 22.65 | 22.65 | 23.54 | |

| Other Non-Current Assets | 3.12 | 3.55 | 3.36 | 3.36 | 2.81 | |

| TOTAL NON-CURRENT ASSETS | 321.54 | 314.99 | 327.84 | 327.84 | 356.43 | |

| CURRENT ASSETS | ||||||

| Current Investments | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Inventories | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Trade Receivables | 1.85 | 6.01 | 4.09 | 4.09 | 2.27 | |

| Cash And Cash Equivalents | 2.61 | 2.18 | 1.67 | 1.67 | 12.75 | |

| Short Term Loans And Advances | 0.69 | 8.98 | 1.36 | 1.36 | 2.92 | |

| OtherCurrentAssets | 3.78 | 2.20 | 2.10 | 2.10 | 4.37 | |

| TOTAL CURRENT ASSETS | 8.93 | 19.37 | 9.22 | 9.22 | 22.30 | |

| TOTAL ASSETS | 330.46 | 334.36 | 337.06 | 337.06 | 378.73 | |

| OTHER ADDITIONAL INFORMATION | ||||||

| CONTINGENT LIABILITIES, COMMITMENTS | ||||||

| Contingent Liabilities | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| CIF VALUE OF IMPORTS | ||||||

| Raw Materials | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Stores, Spares And Loose Tools | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Trade/Other Goods | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Capital Goods | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| EXPENDITURE IN FOREIGN EXCHANGE | ||||||

| Expenditure In Foreign Currency | 0.10 | 0.04 | 0.19 | 0.19 | 0.00 | |

| REMITTANCES IN FOREIGN CURRENCIES FOR DIVIDENDS | ||||||

| Dividend Remittance In Foreign Currency | — | — | — | — | — | |

| EARNINGS IN FOREIGN EXCHANGE | ||||||

| FOB Value Of Goods | — | — | — | — | — | |

| Other Earnings | 19.83 | 16.98 | 20.89 | 20.89 | 31.48 | |

| BONUS DETAILS | ||||||

| Bonus Equity Share Capital | 32.98 | 32.98 | 32.98 | 32.98 | 32.98 | |

| NON-CURRENT INVESTMENTS | ||||||

| Non-Current Investments Quoted Market Value | — | — | — | — | — | |

| Non-Current Investments Unquoted Book Value | 111.63 | 102.72 | 104.33 | 104.33 | 127.04 | |

| CURRENT INVESTMENTS | ||||||

| Current Investments Quoted Market Value | — | — | — | — | — | |

| Current Investments Unquoted Book Value | — | — | — | — | — |

Source : Dion Global Solutions Limited,MoneyControl

Annual Reports Of FCS Software

FCS Software Share Price Today Live Chart

FCS Software Business Analysis

Financial Strength Of FCS Software

Update soon

FCS Software Share Price Target 2023, 2024, 2025, 2026, 2027, 2028, 2029, 2030,2040

We here at financesharetargets. in is going to give you estimated information about stock predictions, price predictions and targets for 2023, 2024, 2025, 2026, 2027, 2028, 2029, 2030 and 2040.

Please keep one thing in mind that this forecast, prediction or any target is only a suggestion given by our analysis. It is almost impossible for any forecast/prediction to be correct.

Errors are always present in any analysis, but we try our best to give you good price stock forecasts/predictions.

FCS Software Share Price Target 2023

If we look at the share price of TTML on NSE, the company has given a return of about 7.69% since the last week of April. If we look at the returns of the last 5 years of the same company, the company has given a return of about 600.00%, which is very high. It is good that the company has given good returns to its shareholders for many consecutive years.

The same company is continuously moving towards development in the same manner and it can be expected to see more similar development of the company in the coming times.

A continuous increase can be seen in the share price of the company, from which it can be estimated that the first target for FCS Software Share price target 2023 can be achieved at ₹ 3.10 and the second target can be achieved at ₹ 4.50.

FCS Software Share Price Target 2024

FCS Software is a leading software solutions company that is performing well in India as well as globally, and has a track record of delivering high quality services and solutions to customers across the globe.

In this way, the company is moving forward at the global level, due to which the company can develop further in the coming time and the first target for FCS Software Share Price Target 2024 can be achieved at ₹ 5.10 and the second target can be achieved at ₹ 6.25.

FCS Software Share Price Target 2025

Talking about the market cap of the company, its market cap is around Rs 360 crores and the company is a small cap company and it is often seen that small cap companies give good returns.

In such a situation, the way this company is moving towards its profits and is continuously moving ahead while developing in the field, with the further development of the company in the coming time, it can be expected that the share price of the company will increase and better returns will be expected. Can

Considering this, according to our analysis, the first target for FCS Software Share Price Target 2025 can be achieved at ₹ 6.50 paise and the second target can be achieved at ₹ 7.85.

FCS Software Share Price Target 2026

The company drives its growth by continuously developing its diversified portfolio of offerings that cater to different industries and sectors. FCS has a strong presence in multiple sectors.

In this way, the company continuously expands its presence and develops its portfolio as per the needs of its customers. This is also one of the reasons why the company is moving towards its development. In the coming times, FCS Software Share Price Target for 2026: First target is ₹8.10 and second target is ₹9. Could be at 86.

FCS Software Share Price Target 2027

FCS Software Company currently employs more than 1500 employees and provides its services globally.

If we look at the customer list of this company, the company has development centers and customer strength at the global level, and the biggest feature of the company is that it has more than 25 years of experience and the company is continuously moving towards its development and increasing its profits. To increase IT services, it is continuously increasing its services.

But due to increasing competition in the market the company is also facing difficulties. However, facing all the challenges, the company is moving ahead and seems to be achieving its development. In such a situation, with the hope of the company developing, the first target for FCS Software Share Price Target 2027 is ₹ 10.10 and the second target is ₹ 11.45. But it can happen.

FCS Software Share Price Target 2028

In this way, the company is moving forward according to the needs of the customers and because the company belongs to the IT sector, and in this field the company provides its services at the global level, due to which people have high expectations from it and the company is continuously fulfilling these expectations. trying to do,

And the company is moving forward with full efforts so that the company can be expected to earn more profits in the coming time, with which the first target for FCS Software Share Price Target 2028 can be at ₹ 11.50 and the second target can be at ₹ 12.90. |

FCS Software Share Price Target 2029

FCS Software company has a global presence. The company has offices in USA, EUROPE, ASIA which helps it to serve the customers in different geographical areas. This global presence helps the company to reach out to different markets and tap into the markets. helps.

In this way, the company has always been working continuously to extend its services to different countries for its development and the company is also making efforts for its further development so that the company can expand further in the future. can be expected.

And due to which the company can get more profits, along with this, the first target for FCS Software Share Price Target 2029 can be at ₹ 13.10 and the second target can be at ₹ 14.75.

FCS Software Share Price Target 2030

The company has been continuously working for its growth and the special features of the company are its complete focus on customer satisfaction, innovation, diverse portfolio, reasonable costs, global presence, experienced management and corporate social responsibility.

All these things have made the company a reliable name in the industry and the company is continuously moving towards development keeping in mind all these as well as the increasing demands of the times.

From which it can be expected that the company can make good profits in the near future due to which the share price of the company can increase. The first target for FCS Software Share Price Target 2030 can be ₹ 15.10 and the second target can be ₹ 17.10.

FCS Software Share Price Target 2040

FCS Software, through its network and its experienced management team, is continuously moving towards development as per the changing needs of the customers and the demand of time, and is moving forward with its special identity at the global level.

And along with all this, the company is also conscious of environmental and social responsibilities and the company is moving forward keeping all these in mind and the way the company is moving ahead with all its efforts, it will bring more success to the company in the future. Can be expected to develop more.

Along with this, the share price of the company can be expected to increase and better returns can be expected, considering that according to our analysis, the first target for FCS Software Share Price Target 2040 can be achieved at ₹ 45 and the second target can be achieved at ₹ 50.

Cash Flow Statement Of FCS Software

| CASH FLOW OF FCS SOFTWARE SOLUTIONS (in Rs. Cr.) | MAR 22 | MAR 21 | NOV 20 | MAR 20 | MAR 19 | |

| 12 mths | 12 mths | 12 mths | 12 mths | 12 mths | ||

| NET PROFIT/LOSS BEFORE EXTRAORDINARY ITEMS AND TAX | 0.53 | -10.46 | -9.74 | -9.74 | 2.60 | |

| Net CashFlow From Operating Activities | 4.62 | 3.82 | -4.99 | -4.99 | -9.83 | |

| Net Cash Used In Investing Activities | 0.89 | 1.39 | -2.88 | -2.88 | -11.81 | |

| Net Cash Used From Financing Activities | -5.08 | -4.70 | -3.20 | -3.20 | 26.27 | |

| Foreign Exchange Gains / Losses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Adjustments On Amalgamation Merger Demerger Others | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| NET INC/DEC IN CASH AND CASH EQUIVALENTS | 0.43 | 0.51 | -11.08 | -11.08 | 4.63 | |

| Cash And Cash Equivalents Begin of Year | 2.18 | 1.67 | 12.75 | 12.75 | 8.12 | |

| Cash And Cash Equivalents End Of Year | 2.61 | 2.18 | 1.67 | 1.67 | 12.75 |

Source : Dion Global Solutions Limited

Profit & Loss Of FCS Software

| Y/e 31 Mar( In .Cr) | Mar-2022 | Mar-2021 | Mar-2020 | Mar-2019 |

|---|---|---|---|---|

| Revenue | 34.62 | 34.06 | 37.33 | 40.40 |

| yoy growth (%) | 1.64 | (8.77) | (7.61) | 17.77 |

| Raw materials | — | — | — | — |

| As % of sales | — | — | — | — |

| Employee costs | (22.50) | (20.59) | (20.09) | (19.01) |

| As % of sales | 64.99 | 60.45 | 53.81 | 47.05 |

| Other costs | (6.38) | (7.84) | (19.50) | (16.57) |

| As % of sales | 18.43 | 23.02 | 52.25 | 41.01 |

| Operating profit | 5.74 | 5.63 | (2.26) | 4.82 |

| OPM | 16.58 | 16.53 | (6.06) | 11.94 |

| Depreciation | (3.86) | (4.62) | (18.20) | (169.49) |

| Interest expense | (2.29) | (2.32) | (2.88) | (1.05) |

| Other income | 1.88 | 2.70 | 3.41 | 2.25 |

| Profit before tax | 1.48 | 1.39 | (19.92) | (163.47) |

| Taxes | (0.45) | (0.75) | (0.82) | (0.81) |

| Tax rate | (30.42) | (54.13) | 4.10 | 0.50 |

| Minorities and other | — | — | — | — |

| Adj. profit | 1.03 | 0.64 | (20.74) | (164.28) |

| Exceptional items | (1.08) | (12.96) | (3.06) | — |

| Net profit | (0.05) | (12.32) | (23.80) | (164.28) |

| yoy growth (%) | (99.58) | (48.23) | (85.51) | 181.48 |

| NPM | (0.15) | (36.18) | (63.76) | (406.59) |

Source – Indiainfoline

Pe Ratio & Book Ratio Of FCS Software

| PE Ratio(x) | 352.83 |

| EPS – TTM(₹) | 0.01 |

| MCap(₹ Cr.) | 359.01 |

| Sectoral MCap Rank | 59 |

| PB Ratio(x) | 1.03 |

| Div Yield(%) | 0.00 |

| Face Value(₹) | 1.00 |

| Beta | 4.90 |

| VWAP(₹) | 2.11 |

| 52W H/L(₹)3.65 / 1.85 |

Source – Economictimes

Company Latest Infra Share News Study

You can easily find the latest infrastructure stock news by searching online news websites or financial news outlets.

Some popular choices include Reuters, Bloomberg, CNBC, and Economic Times.

You may also consider setting up alerts or notifications for news related to Shilpa Medicare Limited or the infrastructure industry,

So that you can stay updated on the latest happenings.

About Investing In FCS Software

Before you invest in the shares of FCS Software or any other company, there is a method of the company,

Investigating and analyzing industry trends requires thorough research and thinking for any investment.

We tell you some points which you can read to ensure your investment:-

Evaluating the company’s financial performance, growth potential and industry trends.

Assessing the company’s management teams and its track record.

Evaluating the competitive position of the company, its financial strengths, weaknesses and looking into the future.

Viewing the company’s valuation and financial metrics that fall short of the company’s value.

If you want to reduce the risk of investment, then you can also go to different companies and by looking at them you can ensure investment.

Current Status Of Company

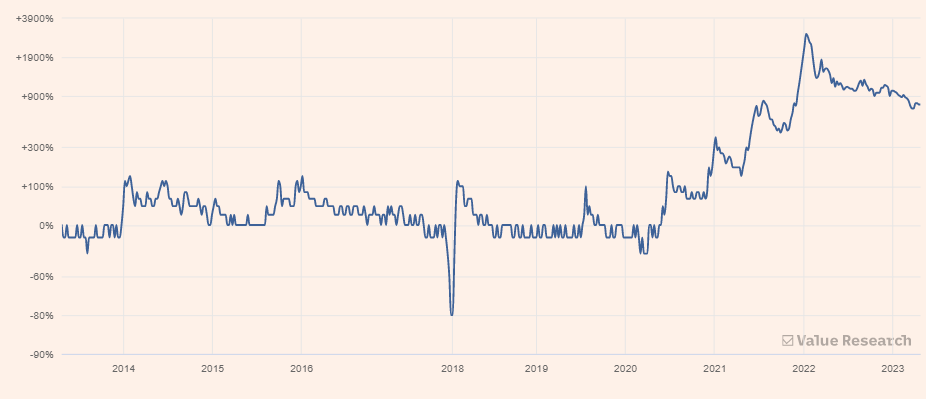

Let us tell you the current status that the growth of this company has gone down which is worrying, you can see this through the live chart provided by us.

Link – LIVE CHART

How To Buy Share

To buy shares of FCS Software or any other company you have to follow these steps:

Open a Demat Account: A demat account is a type of account where your purchased shares are stored electronically. You can open a Demat account with a bank, financial institution or brokerage firm.

Fund your account: After opening a demat account, you need to deposit money into it to buy shares. You can transfer money to your demat account through net banking or by visiting your bank branch.

Choose a Broker: To buy shares, you need to choose a broker who can execute your trades. You can select a broker based on their reputation, commission fees and other services they provide.

Placing Orders: After choosing a broker, you can place orders to buy shares of Shilpa Medicare Limited through their online trading platform or by calling their customer care.

Keep an eye on your investments: After buying shares, it is important to monitor your investments regularly to stay updated with the company’s performance and market trends.

1.Zerodha

2.Upstox

3.5 paisa

4.Angel Broking

5.ICICI Direct

Expert Opinion On FCS Software

Note :-

The stock forecast/price forecast/target given on our website is only for information and educational purpose for stock market participants/traders/investors.

The content we provide here should not be construed as any financial advice or any other type of advice to invest or trade.

It is important to do your own research and analysis before acting on these comments for any stock as the information is only tentative.

Trading and investing involves high risk, please consult your financial advisor before taking any decision and no responsibility will be taken by Financesharetargets.in for any consequences that may arise from acting on these comments.

Read Also – TTML Share Price Target 2023,2025,2028,2030,2040

Read Also – HAL Share Price Target 2023,2025,2028,2030,2040|Earn

Read Also – Asian Paints Share Price Target 2023,2025,2028,2030,2040

THANK YOU FOR VISITING OUR SITE

STAY TUNED…………..