Greenply Company Overview

Greenply Industries Limited is a leading interior infrastructure company in India. Which manufactures various interior infrastructure products like plywood, laminates, decorative veneers and medium density fiberboards (MDF) laminate flooring. Established in 1990, the company has grown to become one of the largest and most trusted players in the Indian plywood industry.

The company’s products are mainly used in the construction and furniture industries. Greenply’s products include plywood and blockboard in varying sizes and thicknesses, decorative veneers and laminates which are available in a wide range of colors and textures as per customer needs. The company also manufactures fiberboard (MDF) which is commonly used for interior decoration, furniture and flooring.

Greenply has a strong presence in the Indian market, with over 45 branches and around 13,000 dealers spread across the country. The company has also been successful in establishing a strong and good export presence in countries like USA, Europe, Middle East and Africa.

The company has invested heavily in research and development, and has also established a research and development center to develop new products and technologies. Along with all this, it also takes special care of the environment, for which it uses environmentally friendly raw materials and processes to reduce the impact on the environment.

Greenply has also received numerous awards and recognition for its products and services, including the prestigious ‘Asia’s Most Promising Brand’ award in 2011.

Greenply has a strong management team that continuously works for the growth and success of the company. Chairman and Managing Director of the company, Mr. Shiv Prakash Mittal has over 30 years of experience in the plywood industry. Today, under his leadership, Greenply has grown from a small manufacturing unit to a leading player in the Indian plywood industry.

Thus, Greenply Industries Limited is seen emerging as a well established and respected company in the Indian plywood industry. The company’s commitment to sustainability and its investment in research and development has helped it consistently stay ahead and stand out in its industry.

Read Also – IRFC Share Price Target 2023,2025,2028,2030,2040

Greenply Business Model

The business model of Greenply Industries Limited works in a manner keeping in mind the needs of the customers. The company has a strong distribution network that helps it reach customers across the country and in export markets.

Manufacturing operations: Greenply’s manufacturing operations can be considered a major part of its business model. The company operates several manufacturing facilities across India, producing quality plywood, laminates, decorative veneers and MDF. The company also uses advanced technology and equipment to produce finished products that meet the highest quality standards.

Distribution and sales: Greenply has a large and strong distribution network consisting of more than 45 branches and around 13,000 dealers across India. The company’s sales team works closely with the dealers, paying close attention to customer needs from identifying them to providing them with the right service. The company also exports its products to countries like USA, Europe, Middle East and Africa, where it has established a strong presence.

Retail operations: Greenply’s retail arm, Greenply Plywood, is an important part of its business model. The retail branch offers a wide range of products and services, including design and installation services, according to home and office interiors.

Research and development: Greenply has invested heavily in research and development, which is an important part of its business model. The company has set up a state-of-the-art Research & Development Center to adapt itself to the evolving needs of its customers and cater to their needs. The R&D team works closely with customers, dealers and industry experts to identify emerging customer needs and tailor these to customers. Through this, the company tries to meet the needs of the customers and keep pace with the times.

Sustainability: Greenply focuses on sustainability, and has given it a special place in its business model, with the company using eco-friendly raw materials and processes to reduce its environmental impact. It promotes a variety of programs for

Management: Greenply has a strong management team that continuously works wholeheartedly for the growth and success of the company. Its management team has an important contribution in taking the company forward.

Thus, looking at its business model, we can understand that Greenply Industries Limited focuses exclusively on manufacturing and selling high quality Plywood, Laminates, Decorative Laminates, and MDF to customers in India and abroad. Besides, for all this the company has a strong management team and the company also pays special attention to the environment during its work.

Read Also – IDFC First Bank Share Price Target 2023,2025,2028,2030,2040

Performance Of Greenply

Greenply Industries Limited, one of the largest companies in the Indian plywood industry, has currently shown good financial performance. Here are the details of the company’s performance in 2023:

Revenue: Greenply reported revenue of about Rs 3,200 crore in fiscal year 2023, an increase of about 12% over the previous year. The increase in revenue was mainly due to higher sales of plywood, laminates and MDF. The company’s strong distribution network and focus on customer needs have helped it increase its market share in these products.

Profit: Greenply’s net profit in fiscal year 2023 was around Rs 100 crore, which is higher than the previous year. The increase in profits can be attributed to higher sales volumes, better products and a focus on customer needs going forward. Streamlining its operations and focus on customers helped it improve its profit margins.

Distribution network: Greenply’s distribution network has made a significant contribution in leading to profits in 2023. The company’s sales team works closely with dealers to identify customer needs and provide solutions that meet the requirements.

The company also expanded its distribution network to reach new markets and customers. Additionally, the company’s Greenply Online, an e-commerce platform, is becoming increasingly popular, allowing customers to purchase products online and conveniently receive them at their doorstep.

The company expanded its retail operations by opening new showrooms in key markets including Mumbai, Delhi and Bangalore.

Research and development: Greenply continues to invest in research and development in 2023. The company’s R&D team works on developing new products and technologies that meet the evolving needs of customers.

Sustainability: The company has consistently placed a major focus on sustainability. The company has also taken several initiatives to reduce its impact on the environment by using eco-friendly raw materials and processes.

Leadership: Leadership remains a key strength of Greenply Industries Limited in 2023. The company has a strong director and management team.

Thus, it can be understood that Greenply Industries Limited has performed well financially. The company’s revenue and profit have increased, which has been possible due to higher sales volumes, better product mix and better cost management. And the company is continuously working with them to increase its development.

Basics Of Greenply

Greenply is India’s largest interior infrastructure company based in India. Some key points about Greenply can be understood as follows:

Company Name – Greenply Industries Limited

Year of Establishment – 1990

Headquarters –

Product portfolio: Greenply offers a wide range of products including Decorative Laminates, Laminates, Plywood and MDF. The company’s products are known for their quality, durability and aesthetics, and are used in a variety of applications including furniture, flooring and interior decoration.

Manufacturing facilities: Greenply operates several state-of-the-art manufacturing facilities across India. The company has invested heavily in R&D facilities to continuously meet the customer needs and keep up with the times, all the while keeping in mind the environmental safety.

Distribution network: Talking about the distribution network of Greenply, it has a strong distribution network which includes more than 45 branches and more than 13,000 dealers across India. The company’s sales team works closely with dealers to identify customer needs as well as provide solutions that meet their needs.

Retail operations: Greenply offers a wide range of plywood, the company’s retail operations serve to provide a wide range of convenience and service to the customers. This enables the company to provide end-to-end convenience to customers from product selection to installation and helps in establishing a strong brand presence in the retail market. The company also has a state-of-the-art R&D facility for SIMs. The company pays special attention to environmental protection along with all this.

Financial performance: Greenply has been performing well for many years. The company reported revenue of around Rs 2,840 crore and net profit of around Rs 100 crore in FY 2022. The financial performance of the company is driven by its strong product portfolio, good and large distribution network and focus on research and development.

Leadership: Greenply has a good leadership capability. The Chairman and Managing Director of the company, Mr. Shiv Prakash Mittal, is widely recognized with respect for his contribution to the plywood industry.

Thus, Greenply Industries Limited has become a leading manufacturer and supplier of plywood, laminates, decorative veneer in India and abroad. Along with this, the company is continuously working to increase its expansion further.

Read Also – Route Mobile Share Price Target 2023,2025,2028,2030,2040

Fundamental Analysis Of Greenply

Update soon

Share Holders & Holding Pattern Of Greenply

Shareholding_Pattern_-_31.03.2021Download

| Shareholding Pattern – Greenply Industries Ltd. | ||

| Holder’s Name | No of Shares | % Share Holding |

| NoOfShares | 122876395 | 100% |

| Promoters | 64287030 | 52.32% |

| ForeignInstitutions | 2653158 | 2.16% |

| NBanksMutualFunds | 40292979 | 32.79% |

| Others | 3118717 | 2.54% |

| GeneralPublic | 12009534 | 9.77% |

| FinancialInstitutions | 514977 | 0.42% |

Services Given By Greenply

Update Soon

Share Price History Of Greenply

Update Soon

Similar Stocks Of Greenply

| Name | Last Price | Market Cap. (Rs. cr.) | Sales Turnover | Net Profit | Total Assets |

| CenturyPlyboard | 524.60 | 11,655.20 | 3,000.88 | 325.27 | 1,761.24 |

| Greenpanel Ind | 301.30 | 3,694.76 | 1,624.43 | 233.36 | 1,269.58 |

| Greenply Ind | 147.10 | 1,807.51 | 1,376.89 | 88.81 | 551.74 |

| Rushil Decor | 297.20 | 788.82 | 624.17 | 22.80 | 706.41 |

| Go to boarding school | 159.45 | 185.26 | 57.25 | 4.38 | 22.02 |

| Archidply Ind | 68.60 | 136.27 | 306.28 | 8.47 | 145.36 |

| The Western Ind | 90.15 | 76.51 | 98.55 | 1.42 | 62.83 |

| Archidply Decor | 61.90 | 34.46 | 42.00 | 0.20 | 66.64 |

| Omfurn India | 48.45 | 33.00 | 30.84 | 0.91 | 37.76 |

| Mangalam Timber | 17.35 | 31.80 | 6.62 | -18.80 | 24.67 |

History Of Greenply

Update Soon

Net Worth Of Greenply

Market capitalization Vaibhav Global is ₹18.03 Billion.

Income Statement Analysis Of Greenply

| No. of Mths Year Ending | 12 Mar-21* | 12 Mar-22* | % Change | |

|---|---|---|---|---|

| Net Sales | Rs m | 11,653 | 15,628 | 34.1% |

| Other income | Rs m | 84 | 99 | 18.0% |

| Total Revenues | Rs m | 11,737 | 15,727 | 34.0% |

| Gross profit | Rs m | 1,151 | 1,503 | 30.6% |

| Depreciation | Rs m | 231 | 258 | 12.0% |

| Interest | Rs m | 167 | 119 | -28.3% |

| Profit before tax | Rs m | 837 | 1,224 | 46.1% |

| Tax | Rs m | 205 | 303 | 47.8% |

| Profit after tax | Rs m | 633 | 921 | 45.6% |

| Gross profit margin | % | 9.9 | 9.6 | |

| Effective tax rate | % | 24.4 | 24.7 | |

| Net profit margin | % | 5.4 | 5.9 | |

Source: Accord Fintech, Equitymaster

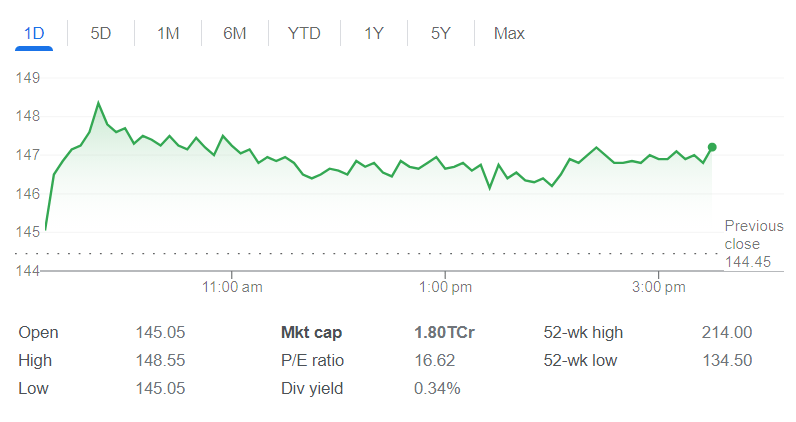

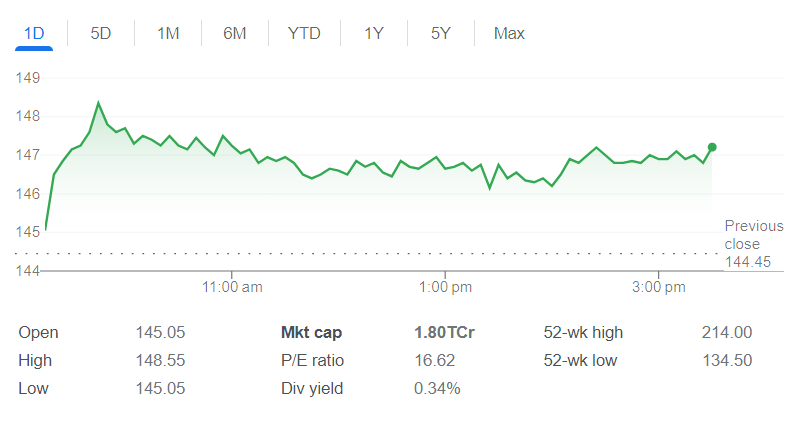

Valuation Of Greenply(You Can Click On Chart For live)

Vision & Value Of Greenply

Update soon

Products Of Greenply

Update Soon

Competitor Comparision Of Greenply

| Company Name | LTP (₹) | P/E (%) | Mkt.Cap (₹Cr.) | NP Qtr (₹Cr.) | Div.Yield (%) | Sales Qtr (₹.Cr) | Book Value (₹) |

|---|---|---|---|---|---|---|---|

| Gujarat Gas Ltd GUJGASLTD | 469.80 BSE | 20.09 | 32,340.57 | 371.26 | 0.43 | 3,684.29 | 90.78 |

| Indian Energy Exchange Ltd IEX | 154.95 BSE | 47.53 | 13,816.78 | 71.18 | 1.30 | 100.28 | 8.43 |

| Century Plyboards (India) Ltd CENTURYPLY | 525.50 BSE | 33.79 | 11,657.42 | 81.36 | 0.29 | 877.17 | 76.62 |

| Computer Age Management Services Ltd CAMS | 2,050.35 BSE | 37.06 | 10,045.40 | 70.98 | 1.89 | 233.48 | 136.51 |

| Godrej Agrovet Ltd GODREJAGRO | 444.00 BSE | 24.14 | 8,534.83 | 136.17 | 2.14 | 1,740.31 | 99.77 |

Source- Indiainfoline

Speciality Of Greenply In Its Sector

Update soon

Revenue Distribution By Sectors Of Greenply

Update soon

Balance Sheet Analysis Of Greenply

| BALANCE SHEET OF GREENPLY INDUSTRIES (in Rs. Cr.) | MAR 22 | MAR 21 | MAR 20 | MAR 19 | MAR 18 | |

| 12 mths | 12 mths | 12 mths | 12 mths | 12 mths | ||

| EQUITIES AND LIABILITIES | ||||||

| SHAREHOLDER’S FUNDS | ||||||

| Equity Share Capital | 12.26 | 12.26 | 12.26 | 12.26 | 12.26 | |

| TOTAL SHARE CAPITAL | 12.26 | 12.26 | 12.26 | 12.26 | 12.26 | |

| Reserves and Surplus | 495.79 | 398.48 | 344.70 | 319.08 | 902.79 | |

| TOTAL RESERVES AND SURPLUS | 495.79 | 398.48 | 344.70 | 319.08 | 902.79 | |

| TOTAL SHAREHOLDERS FUNDS | 508.05 | 410.74 | 356.96 | 331.34 | 915.05 | |

| NON-CURRENT LIABILITIES | ||||||

| Long Term Borrowings | 12.66 | 32.13 | 23.84 | 36.16 | 459.11 | |

| Deferred Tax Liabilities [Net] | 0.00 | 0.00 | 0.00 | 0.00 | 26.45 | |

| Other Long Term Liabilities | 5.30 | 8.59 | 9.11 | 7.85 | 78.12 | |

| Long Term Provisions | 5.58 | 5.46 | 5.18 | 5.05 | 21.85 | |

| TOTAL NON-CURRENT LIABILITIES | 23.54 | 46.18 | 38.13 | 49.06 | 585.53 | |

| CURRENT LIABILITIES | ||||||

| Short Term Borrowings | 31.03 | 9.96 | 105.44 | 94.29 | 168.48 | |

| Trade Payables | 220.97 | 200.38 | 218.41 | 241.49 | 211.01 | |

| Other Current Liabilities | 45.95 | 53.94 | 44.85 | 55.39 | 171.69 | |

| Short Term Provisions | 16.87 | 15.79 | 29.60 | 0.47 | 4.70 | |

| TOTAL CURRENT LIABILITIES | 314.82 | 280.07 | 398.29 | 391.64 | 555.88 | |

| TOTAL CAPITAL AND LIABILITIES | 846.41 | 737.00 | 793.38 | 772.05 | 2,056.47 | |

| ASSETS | ||||||

| NON-CURRENT ASSETS | ||||||

| Tangible Assets | 174.72 | 189.80 | 193.24 | 162.36 | 477.10 | |

| Intangible Assets | 10.51 | 1.50 | 6.72 | 6.18 | 5.88 | |

| Capital Work-In-Progress | 1.40 | 4.62 | 3.97 | 4.41 | 770.40 | |

| Other Assets | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| FIXED ASSETS | 186.63 | 195.92 | 203.92 | 174.30 | 1,253.38 | |

| Non-Current Investments | 228.05 | 45.36 | 44.31 | 42.23 | 76.37 | |

| Deferred Tax Assets [Net] | 7.17 | 6.39 | 10.48 | 4.11 | 0.00 | |

| Long Term Loans And Advances | 19.39 | 19.00 | 22.44 | 24.58 | 28.99 | |

| Other Non-Current Assets | 23.88 | 20.90 | 17.22 | 56.38 | 79.19 | |

| TOTAL NON-CURRENT ASSETS | 465.12 | 287.57 | 298.38 | 301.60 | 1,437.93 | |

| CURRENT ASSETS | ||||||

| Current Investments | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Inventories | 172.37 | 131.39 | 143.80 | 141.61 | 214.97 | |

| Trade Receivables | 158.87 | 163.32 | 307.93 | 283.37 | 284.40 | |

| Cash And Cash Equivalents | 20.49 | 124.12 | 9.66 | 18.10 | 30.00 | |

| Short Term Loans And Advances | 0.74 | 4.28 | 3.32 | 0.45 | 1.38 | |

| OtherCurrentAssets | 28.82 | 26.32 | 30.29 | 26.93 | 87.79 | |

| TOTAL CURRENT ASSETS | 381.29 | 449.43 | 494.99 | 470.45 | 618.54 | |

| TOTAL ASSETS | 846.41 | 737.00 | 793.38 | 772.05 | 2,056.47 | |

| OTHER ADDITIONAL INFORMATION | ||||||

| CONTINGENT LIABILITIES, COMMITMENTS | ||||||

| Contingent Liabilities | 618.95 | 173.04 | 164.90 | 24.55 | 206.74 | |

| CIF VALUE OF IMPORTS | ||||||

| Raw Materials | 92.42 | 56.05 | 92.30 | 97.61 | 91.87 | |

| Stores, Spares And Loose Tools | 28.08 | 23.20 | 11.67 | 17.63 | 3.46 | |

| Trade/Other Goods | 28.08 | 23.20 | 11.67 | 17.63 | 3.46 | |

| Capital Goods | 0.42 | 0.94 | 0.87 | 3.53 | 180.14 | |

| EXPENDITURE IN FOREIGN EXCHANGE | ||||||

| Expenditure In Foreign Currency | 0.00 | 0.00 | 0.00 | 0.00 | 281.11 | |

| REMITTANCES IN FOREIGN CURRENCIES FOR DIVIDENDS | ||||||

| Dividend Remittance In Foreign Currency | — | — | — | — | — | |

| EARNINGS IN FOREIGN EXCHANGE | ||||||

| FOB Value Of Goods | 2.10 | 0.10 | 0.27 | 0.67 | 30.85 | |

| Other Earnings | — | — | — | — | — | |

| BONUS DETAILS | ||||||

| Bonus Equity Share Capital | — | — | — | — | — | |

| NON-CURRENT INVESTMENTS | ||||||

| Non-Current Investments Quoted Market Value | 0.01 | 0.01 | 0.00 | 0.00 | 0.01 | |

| Non-Current Investments Unquoted Book Value | 3.81 | 3.13 | 2.09 | 42.22 | 76.36 | |

| CURRENT INVESTMENTS | ||||||

| Current Investments Quoted Market Value | — | — | — | — | — | |

| Current Investments Unquoted Book Value | — | — | — | — | — |

Source : Dion Global Solutions Limited,Moneycontrol

Annual Reports Of Greenply

Annual_Results_2021-22Download

Greenply Share Price Today Live Chart

Greenply Business Analysis

Financial Strength Of Greenply

Update soon

Greenply Share Price Target 2023, 2024, 2025, 2026, 2027, 2028, 2029, 2030,2040

We here at financesharetargets. in is going to give you approximate information about stock forecast, price forecast and target for 2023, 2024, 2025, 2026, 2027, 2028, 2029, 2030 and 2040. Please keep one thing in mind that this is not a forecast, prediction or any The target is only a suggestion given by our analysis.

It is almost impossible for any forecast/prediction to be correct. Errors are always present in any analysis, but we try our best to give you good price stock forecasts/predictions.

Greenply Share Price Target 2023

If we look at the year to date share price return of Greenply on NSE, it has given a return of about 0.82% to its investors in the year to date, whereas if we look at the maximum return of the company, the company has given a return of about 10,885.07% to its investors. Return has been given.

At the same time, its share price has been seen trading in a good position since the beginning of the year till now, due to which it can be estimated that the share price of the company can increase further, which will become the first target for Greenply Share Price Target 2023. ₹150 and second target can be achieved at ₹160.

Greenply share price target 2025

A significant growth has been seen in the revenue of the company. The company seems to be continuously moving towards its growth. Talking about the market cap of the company, its market cap is around 18.43B INR.

With which this company is a small cap company and it is mostly seen that small cap company gives good returns which can be expected.

Considering this, the company can give it to its shareholders, according to our analysis, the first target for Greenply share price target 2025 can be at ₹ 180 and the second target can be at ₹ 200.

Greenply share price target 2030

Greenply company is India’s largest interior infrastructure company and the company is continuously working to further expand its expansion. For this, the company is expanding its product portfolio along with providing quality to its products and is moving forward by understanding the needs of the customers and adapting itself to the times.

And the company also uses state-of-the-art R&D facilities for all this, thus the company seems to be continuously moving towards its expansion with time.

Due to which in the coming time, along with the development of the company, it can also be expected to get good profits and increase in share price, seeing this, according to our analysis, the first target for Greenply share price target 2030 is ₹ 280 and the second target is ₹ 300. can be obtained at

Greenply share price target 2040

The way the company is providing its services to the people through its large network and its products, it is also trying to develop its network further by paying attention to innovation as per the times and amidst all this, environmental protection is being maintained. It is also moving forward paying special attention to

Due to this, the company can be expected to develop further in the coming time, due to which the share price of the company can increase further and better returns can also be expected in the coming time. Considering this, according to our analysis, the first target for Greenply share price target 2040 can be at ₹580 and the second target can be at ₹600.

Cash Flow Statement Of Greenply

| CASH FLOW OF GREENPLY INDUSTRIES (in Rs. Cr.) | MAR 22 | MAR 21 | MAR 20 | MAR 19 | MAR 18 | |

| 12 mths | 12 mths | 12 mths | 12 mths | 12 mths | ||

| NET PROFIT/LOSS BEFORE EXTRAORDINARY ITEMS AND TAX | 124.99 | 81.38 | 60.70 | 111.19 | 164.13 | |

| Net CashFlow From Operating Activities | 91.61 | 227.79 | 57.64 | 97.83 | 113.39 | |

| Net Cash Used In Investing Activities | -129.45 | -124.67 | -57.20 | -83.96 | -328.00 | |

| Net Cash Used From Financing Activities | 80.43 | -92.16 | -18.99 | -27.64 | 164.44 | |

| Foreign Exchange Gains / Losses | -0.67 | 0.82 | -1.28 | 0.15 | 0.00 | |

| Adjustments On Amalgamation Merger Demerger Others | 0.00 | 0.00 | 0.00 | -5.21 | 0.00 | |

| NET INC/DEC IN CASH AND CASH EQUIVALENTS | 41.93 | 11.78 | -19.83 | -18.83 | -50.17 | |

| Cash And Cash Equivalents Begin of Year | -3.91 | -15.69 | 4.14 | 22.97 | 73.14 | |

| Cash And Cash Equivalents End Of Year | 38.01 | -3.91 | -15.69 | 4.14 | 22.97 |

Source : Dion Global Solutions Limited,Moneycontrol

Profit & Loss Of Greenply

| PROFIT & LOSS ACCOUNT OF GREENPLY INDUSTRIES (in Rs. Cr.) | MAR 22 | MAR 21 | MAR 20 | MAR 19 | MAR 18 | |

| 12 mths | 12 mths | 12 mths | 12 mths | 12 mths | ||

| INCOME | ||||||

| REVENUE FROM OPERATIONS [GROSS] | 1,371.45 | 1,011.67 | 1,263.07 | 1,275.76 | 1,675.12 | |

| Less: Excise/Sevice Tax/Other Levies | 0.00 | 0.00 | 0.00 | 0.00 | 23.77 | |

| REVENUE FROM OPERATIONS [NET] | 1,371.45 | 1,011.67 | 1,263.07 | 1,275.76 | 1,651.35 | |

| TOTAL OPERATING REVENUES | 1,376.89 | 1,015.39 | 1,267.68 | 1,283.79 | 1,680.37 | |

| Other Income | 13.17 | 9.10 | 6.19 | 6.46 | 3.78 | |

| TOTAL REVENUE | 1,390.06 | 1,024.49 | 1,273.87 | 1,290.25 | 1,684.15 | |

| EXPENSES | ||||||

| Cost Of Materials Consumed | 494.89 | 352.97 | 496.54 | 507.79 | 639.61 | |

| Purchase Of Stock-In Trade | 371.74 | 239.37 | 277.15 | 306.05 | 262.54 | |

| Operating And Direct Expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Changes In Inventories Of FG,WIP And Stock-In Trade | -23.01 | 14.05 | -2.57 | -12.12 | -18.09 | |

| Employee Benefit Expenses | 172.60 | 131.25 | 145.60 | 140.51 | 185.20 | |

| Finance Costs | 5.78 | 11.05 | 16.85 | 14.81 | 9.47 | |

| Depreciation And Amortisation Expenses | 18.61 | 16.55 | 21.07 | 18.72 | 44.81 | |

| Other Expenses | 230.28 | 180.85 | 223.21 | 221.69 | 371.40 | |

| TOTAL EXPENSES | 1,270.89 | 946.08 | 1,177.85 | 1,197.44 | 1,494.95 | |

| PROFIT/LOSS BEFORE EXCEPTIONAL, EXTRAORDINARY ITEMS AND TAX | 119.17 | 78.40 | 96.01 | 92.81 | 189.20 | |

| Exceptional Items | 0.00 | 0.00 | -49.97 | 0.00 | 0.00 | |

| PROFIT/LOSS BEFORE TAX | 119.17 | 78.40 | 46.04 | 92.81 | 189.20 | |

| TAX EXPENSES-CONTINUED OPERATIONS | ||||||

| Current Tax | 31.24 | 16.47 | 19.46 | 22.93 | 40.66 | |

| Less: MAT Credit Entitlement | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Deferred Tax | -0.88 | 4.00 | -6.01 | 8.59 | 12.85 | |

| Tax For Earlier Years | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| TOTAL TAX EXPENSES | 30.36 | 20.47 | 13.44 | 31.52 | 53.51 | |

| PROFIT/LOSS AFTER TAX AND BEFORE EXTRAORDINARY ITEMS | 88.81 | 57.93 | 32.60 | 61.29 | 135.69 | |

| PROFIT/LOSS FROM CONTINUING OPERATIONS | 88.81 | 57.93 | 32.60 | 61.29 | 135.69 | |

| PROFIT/LOSS FOR THE PERIOD | 88.81 | 57.93 | 32.60 | 61.29 | 135.69 | |

| OTHER ADDITIONAL INFORMATION | ||||||

| EARNINGS PER SHARE | ||||||

| Basic EPS (Rs.) | 7.24 | 4.72 | 2.66 | 5.00 | 11.07 | |

| Diluted EPS (Rs.) | 7.24 | 4.72 | 2.66 | 5.00 | 11.07 | |

| VALUE OF IMPORTED AND INDIGENIOUS RAW MATERIALS STORES, SPARES AND LOOSE TOOLS | ||||||

| Imported Raw Materials | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Indigenous Raw Materials | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| STORES, SPARES AND LOOSE TOOLS | ||||||

| Imported Stores And Spares | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Indigenous Stores And Spares | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| DIVIDEND AND DIVIDEND PERCENTAGE | ||||||

| Equity Share Dividend | 4.91 | 4.91 | 4.91 | 7.36 | 7.36 | |

| Tax On Dividend | 0.00 | 0.00 | 1.01 | 1.51 | 1.50 | |

| Equity Dividend Rate (%) | 50.00 | 40.00 | 40.00 | 40.00 | 60.00 |

Source : Dion Global Solutions Limited,Moneycontrol

Pe Ratio & Book Ratio Of Greenply

| PE Ratio(x) | 16.53 |

| EPS – TTM(₹) | 8.90 |

| MCap(₹ Cr.) | 1,774.95 |

| Sectoral MCap Rank | 16 |

| PB Ratio(x) | 3.30 |

| Div Yield(%) | 0.34 |

| Face Value(₹) | 1.00 |

| Beta | 1.91 |

| VWAP(₹) | 147.07 |

| 52W H/L(₹)219.25 / 134.50 |

Company Latest Infra Share News Study

You can easily find the latest infrastructure stock news by searching online news websites or financial news outlets.

Some popular choices include Reuters, Bloomberg, CNBC, and Economic Times.

You may also consider setting up alerts or notifications for news related to Shilpa Medicare Limited or the infrastructure industry,

So that you can stay updated on the latest happenings.

About Investing In Greenply

Before you invest in the shares of Greenply or any other company, there is a method of the company,

Investigating and analyzing industry trends requires thorough research and thinking for any investment.

We tell you some points which you can read to ensure your investment:-

Evaluating the company’s financial performance, growth potential and industry trends.

Assessing the company’s management teams and its track record.

Evaluating the competitive position of the company, its financial strengths, weaknesses and looking into the future.

Viewing the company’s valuation and financial metrics that fall short of the company’s value.

If you want to reduce the risk of investment, then you can also go to different companies and by looking at them you can ensure investment.

Read Also – BEL SHARE PRICE TARGET 2022,2023,2024,2025,2026,2027,2028,2029,2030,2040

Current Status Of Company

Let us tell you the current status that the growth of this company has gone down which is worrying, you can see this through the live chart provided by us.

Link – LIVE CHART

How To Buy Share

To buy shares of Greenply or any other company you need to follow these steps:

Open a Demat Account: A demat account is a type of account where your purchased shares are stored electronically. You can open a Demat account with a bank, financial institution or brokerage firm.

Fund your account: After opening a demat account, you need to deposit money into it to buy shares. You can transfer money to your demat account through net banking or by visiting your bank branch.

Choose a Broker: To buy shares, you need to choose a broker who can execute your trades. You can select a broker based on their reputation, commission fees and other services they provide.

Placing Orders: After choosing a broker, you can place orders to buy shares of Shilpa Medicare Limited through their online trading platform or by calling their customer care.

Keep an eye on your investments: After buying shares, it is important to monitor your investments regularly to stay updated with the company’s performance and market trends.

1.Zerodha

2.Upstox

3.5 paisa

4.Angel Broking

5.ICICI Direct

Expert Opinion On Greenply

Note

The stock forecast/price forecast/target given on our website is only for information and educational purpose for stock market participants/traders/investors.

The content we provide here should not be construed as any financial advice or any other type of advice to invest or trade.

It is important to do your own research and analysis before acting on these comments for any stock as the information is only tentative.

Trading and investing involves high risk, please consult your financial advisor before taking any decision and no responsibility will be taken by Financesharetargets.in for any consequences that may arise from acting on these comments.

THANK YOU FOR VISITING OUR SITE

STAY TUNED…………..